Square Enix 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

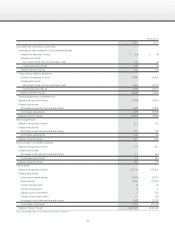

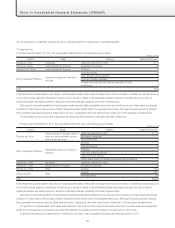

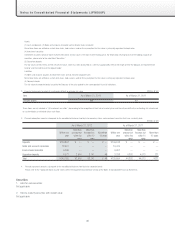

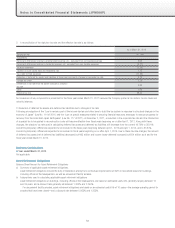

(2) Dividends with a record date during this fiscal year, but whose effective date falls in the following fiscal year

Total dividends Dividends per share

Date of approval Type of shares (Millions of yen) Source of dividends (Yen) Record date Effective date

May 18, 2011

(Board of Directors’ Meeting) Common stock ¥2,301 Retained earnings ¥20 March 31, 2011 June 23, 2011

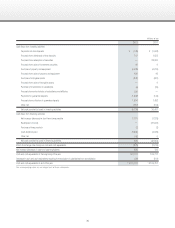

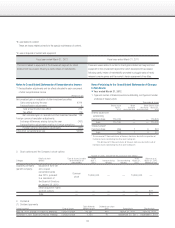

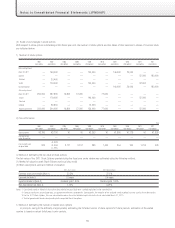

Notes to Consolidated Statements of Cash Flows

*1 A reconciliation of cash and cash equivalents in the consolidated statements of cash flows to the corresponding amount disclosed in the consolidated balance

sheets is as follows:

Millions of yen

Fiscal year ended March 31, 2012 Fiscal year ended March 31, 2011

Cash and deposits ¥111,495 ¥111,126

Time deposits with maturity periods over three months (1,379) (1,375)

Cash and cash equivalents ¥110,116 ¥109,751

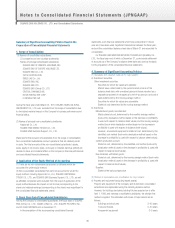

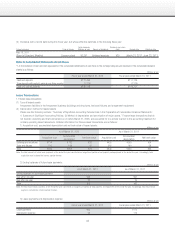

Lease Transactions

1. Finance lease transactions

(1) Type of leased assets

Amusement facilities in the Amusement business (buildings and structures, tools and fixtures and amusement equipment)

(2) Depreciation method for leased assets

Please see the following sections: “Summary of Significant Accounting Policies Used in the Preparation of Consolidated Financial Statements;

4. Summary of Significant Accounting Policies; (2) Method of depreciation and amortization of major assets.” Finance lease transactions that do

not transfer ownership and that commenced on or before March 31, 2008, are accounted for in a similar manner to the accounting treatment for

ordinary operating lease transactions. Detailed information for finance lease transactions are as follows:

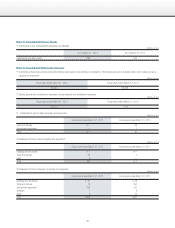

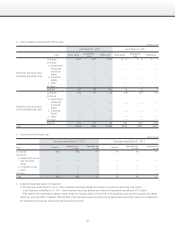

1) Acquisition cost, accumulated depreciation and net book value of leased assets: Millions of yen

As of March 31, 2012 As of March 31, 2011

Acquisition cost Accumulated

depreciation Net book value Acquisition cost Accumulated

depreciation Net book value

Buildings and structures ¥114 ¥ 83 ¥30 ¥425 ¥390 ¥34

Tools and fixtures 210 168 42 218 160 58

Total ¥325 ¥252 ¥73 ¥643 ¥550 ¥92

Note: The total amount of future lease payments at the end of the year constituted an insignificant portion of net property and equipment at the end of the year. Accordingly, total

acquisition cost included the interest portion thereon.

2) Ending balances of future lease payments:

Millions of yen

As of March 31, 2012 As of March 31, 2011

Ending balances of future lease payments

Due within one year ¥49 ¥67

Due after one year 23 24

Total ¥73 ¥92

Note: The total future lease payments at the end of the year constituted an insignificant portion of total property and equipment at the end of the year. Accordingly, total future lease

payments included the interest portion thereon.

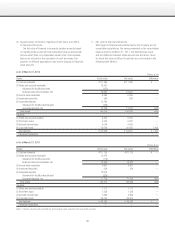

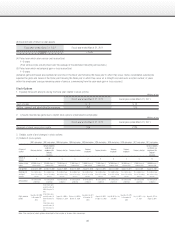

3) Lease payments and depreciation expense: Millions of yen

Fiscal year ended March 31, 2012 Fiscal year ended March 31, 2011

Lease payments ¥95 ¥175

Depreciation expense 95 175