Square Enix 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

B) Intangible assets (excluding leased assets)

Amortized using the straight-line method. Software used in-house is

amortized using the straight-line method based on an internal estimate of its

useful life (five years).

C) Leased assets

Leased assets under finance lease transactions that do not transfer

ownership.

Depreciation for leased assets is computed under the straight-line

method over the lease term with no residual value. Among finance lease

transactions that do not transfer ownership, those lease transactions that

commenced on or before March 31, 2008, are accounted for in the same

manner as operating lease transactions.

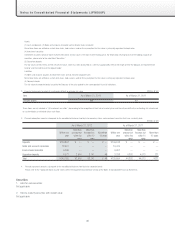

(3) Accounting for allowances and provisions:

A) Allowance for doubtful accounts

An allowance for doubtful accounts provides for possible losses on

defaults of receivables. The allowance is made up of two components:

the estimated credit loss on doubtful receivables based on an individual

assessment of each account, and a general reserve calculated based on

historical default rates.

B) Provision for bonuses

A provision for bonuses is provided for payments to employees of the

Company and certain consolidated subsidiaries at the amount expected

to be paid in respect of the calculation period ended on the balance sheet

date.

C) Provision for sales returns

At certain consolidated subsidiaries prior to the fiscal year ended March

31, 2012, provisions are provided for losses on the return of published

materials, at an amount calculated based on historical experience prior

to this fiscal year and provisions are provided for losses on the return

of game software and other, comprising an estimated amount of future

losses assessed based on the probability of the return by each game title.

D) Provision for game arcade closings

For closures of game arcades that have been determined at certain

consolidated subsidiaries, a provision is provided at an amount in line with

reasonable estimates of future losses on such closures.

E) Provision for employees’ retirement benefits

At the Company and certain consolidated subsidiaries, a provision for

employees’ and directors’ retirement benefits is provided at the amount

incurred during the fiscal year based on the estimated present value of

the projected benefit obligation and pension plan assets. Unrecognized

actuarial differences are fully amortized in the year following the year in

which they occur. At certain consolidated subsidiaries, amortization for

each fiscal year is made using the straight-line method over a certain

period (five years) within the average remaining service period of the

eligible employees when the differences are recognized, commencing

from the year after year in which they are incurred. Unrecognized prior

service cost is amortized over a certain period (one year or five years)

within the average remaining service period of the eligible employees.

F) Provision for directors’ retirement benefits

At the Company and certain consolidated subsidiaries a provision for

directors’ retirement benefits is provided to adequately cover the costs of

directors’ retirement benefits, which are accounted for on an accrual basis

in accordance with internal policy.

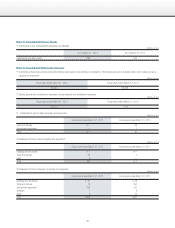

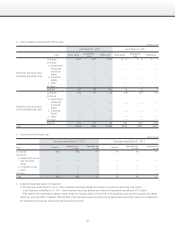

(4) Translation of foreign currency transactions and accounts:

All monetary assets and liabilities of the Company and its overseas

consolidated subsidiaries denominated in foreign currencies are translated

at the balance sheet date at the year end rates. The resulting translation

gains or losses are credited or charged to income. All assets and liabilities

of overseas consolidated subsidiaries are translated as of the balance

sheet date at the year end rates, and all income and expense accounts are

translated at the average rates for their respective periods. The resulting

translation adjustments are recorded in net assets as “Foreign currency

translation adjustments” and are included in minority interests in consolidated

subsidiaries.

(5) Scope of cash and cash equivalents in the consolidated statements of

cash flows:

Cash and cash equivalents in the consolidated statements of cash flows

comprises cash on hand, bank deposits which may be withdrawn on demand

and short-term investments with an original maturity of three months or less

and with minimal risk of fluctuations in value.

(6) Additional accounting policies used to prepare consolidated financial

statements:

Accounting treatment of consumption taxes and local consumption taxes

Income statement items are presented exclusive of consumption taxes and

local consumption taxes.