Square Enix 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

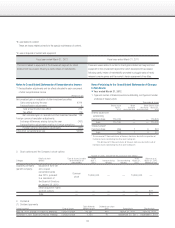

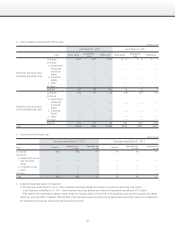

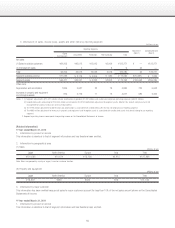

Tax Effect Accounting

1. Significant components of deferred tax assets and liabilities are summarized as follows:

Millions of yen

As of March 31, 2012 As of March 31, 2011

Deferred tax assets

1) Current assets

Enterprise tax payable ¥ 344 ¥ 212

Business office tax payable 41 46

Provision for bonuses 457 440

Accrued expenses 170 659

Provision for sales returns 122 200

Non-deductible portion of allowance for doubtful accounts 68 88

Tax credits — 503

Loss on write-offs of content production account 3,204 2,237

Loss on inventory revaluation 818 645

Provision for game arcade closings 98 197

Loss carried forward 99 171

Other 218 145

Valuation allowance (444) (863)

Offset to deferred tax liabilities (current) (176) (191)

Total 5,022 4,493

2) Non-current assets

Non-deductible portion of provision for employees’ retirement

benefits 1,395 1,252

Provision for directors’ retirement benefits 82 96

Expense for stock-based compensation 344 336

Non-deductible depreciation expense of property and equipment 123 200

Asset retirement obligations 49 181

Impairment loss 308 424

Loss on evaluation of investments in securities 306 456

Loss on evaluation of stocks of subsidiaries and affiliates 51 —

Non-deductible portion of allowance for doubtful accounts 59 67

Non-deductible portion of excess expenses on lump-sum

depreciable assets 145 219

Loss carried forward, and others, at overseas subsidiaries 845 1,720

Provision for game arcade closings 211 238

Tax credits 119 —

Loss carried forward 59 173

Other 134 443

Valuation allowance (2,556) (2,936)

Offset to deferred tax liabilities (non-current) (1,221) (1,792)

Total 460 1,082

Total deferred tax assets 5,483 5,576

Deferred tax liabilities

1) Current liabilities

Accrued expenses and other cost calculation details 151 190

Other 25 0

Offset to deferred tax assets (non-current assets) (176) (191)

Total — —

2) Non-current liabilities

Non-current assets 1,654 1,544

Tax effects from intangible non-current assets relating to

business combinations 1,804 2,076

Other 367 749

Offset to deferred tax assets (non-current) (1,221) (1,792)

Total 2,605 2,577

Total deferred tax liabilities 2,605 2,577

Balance: Net deferred tax assets ¥ 2,878 ¥ 2,998