Square Enix 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

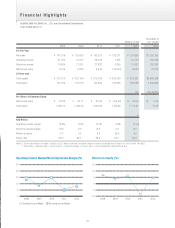

saw an increase: Digital Entertainment (¥1,319 million),

Amusement (¥374 million) and Merchandising (¥62 million).

Publication had a decrease in profit of ¥629 million. We saw an

improvement in Eliminations or Unallocated cost of ¥2,262

million, which is a result of the reassessment of assets from the

last fiscal year.

The Digital Entertainment segment increased in profits, but

the structure of the business has changed more than the

numbers. I will elaborate on this point later.

Sales in the Amusement segment are flat but generated

more profits. The arcade business is getting out of its slump,

and we see the fruit of ongoing efforts to reduce fixed costs.

That said, profit contributions by arcade game machines were

limited this fiscal year whereas next fiscal year will see the

release of major, new arcade titles. While many operators have

withdrawn from this segment, we can expect to enjoy the profit

of the remaining player since the contraction of the market is

limited. Although this could hardly be described as a fast-

growing sector, I will ensure that it brings stable profit

contributions alongside its primary entertainment objective:

producing live experiences that cannot be recreated at home.

The Publication segment peaked in the fiscal year ended

March 31, 2010, and profits have steadily decreased since

then. We saw huge success with “FULLMETAL ALCHEMIST,”

followed by hit titles every year such as “Black Butler” and

“SOUL EATER.” In this fiscal year we were able to produce

quality, popular titles on a regular basis, such as “Inu Boku

Secret Service.” However, an increase in the number of serial

publications and a focus on the production of animated series

created a rise in fixed costs, which leads to this segment’s

downtrend in profit margins. That said, a more fundamental

issue of profitability within this segment is not rising expenses,

but rather revenue opportunities being limited to the domestic

comics market. Once we establish capabilities to produce a

string of hits, I am confident we can overcome the status quo

by entering overseas markets and online businesses, though

this will take some time.

Changes in the Undercurrent of the Digital

Entertainment Business

The Digital Entertainment business is a broad segment that

covers all types of devices and all genres of games. We group

this segment broadly because it is impossible to find appropriate

classifications in this time of transition for the industry. In other

words, even if we create some classifications for this segment,

those classifications may rapidly change, and we cannot

guarantee the consistency of a segment within our reporting.

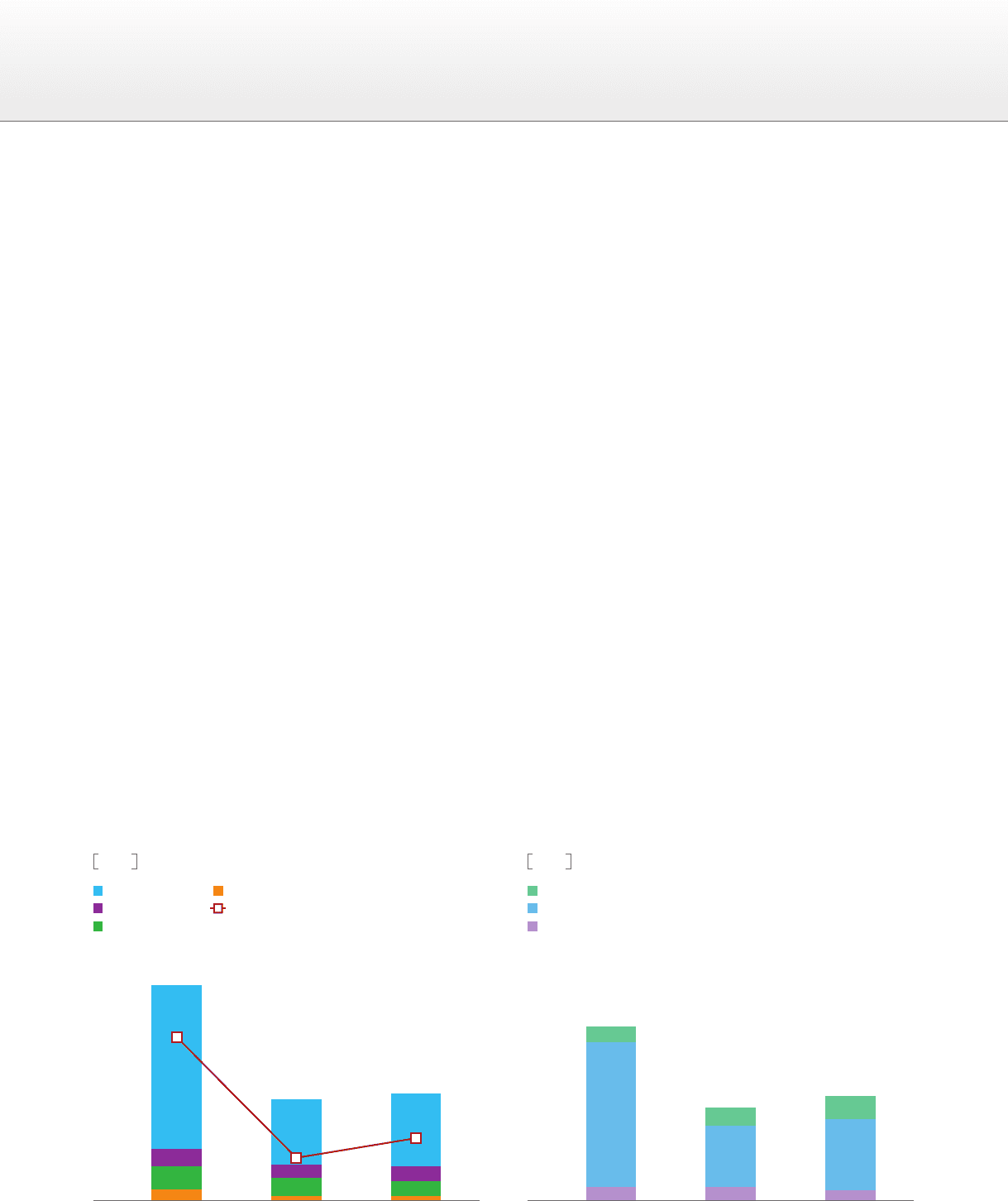

However, I would like to show you a breakdown of the segment

in more detail to promote understanding of our business

performance. Therefore, I will divide this segment into three

categories for convenience’s sake (Figure 2): MMO games

(Massively Multiplayer Online games), SN games (Social

Operating Income by Business Segment

Figure 1

Digital Entertainment

Amusement

Merchandising

Company Total Operating Income

(Net of eliminations or unallocated)

Publication

(Billions of yen)

FY2010 FY2011 FY2012

40

30

20

10

0

SN Games

HD Games

MMO Games

(Billions of yen)

160

120

80

40

0

FY2010 FY2011 FY2012

Net Sales of Digital Entertainment Segment

Figure 2

03