Square Enix 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

5. Basic Policy for Profit Distribution and Dividends

The Group recognizes the return of profits to shareholders as one of

its most important management tasks. The Group maintains internal

reserves to enable priority to be given to investments that will

enhance the value of the Group. Such investments may include

capital investments and M&A for the purpose of expanding existing

businesses and developing new businesses. The retention of

internal reserves is done while also taking into account return to

shareholders, operating performance and the optimal balance for

stable dividends. Accordingly, the Group strives to maintain stable

and continuous dividends. The portion of dividends linked to

operating results is determined by setting a consolidated payout

ratio target of approximately 30%.

The Company’s basic policy is to pay dividends from retained

earnings twice a year, through an interim dividend and a year-end

dividend. The bodies authorized to determine dividends paid from

retained earnings for the fiscal year ended March 31, 2012 were

the Annual General Meeting of Shareholders or the Board of

Directors in the case of the year-end dividend, and the Board of

Directors in the case of the interim dividend.

Total dividends applicable to the fiscal year were ¥30 per share,

comprising an interim dividend of ¥10 and a year-end dividend of

¥20. In accordance with Article 459 of the Companies Act, the

Company’s Articles of Incorporation stipulate that dividends paid

from retained earnings and other related matters may be determined

by a resolution of the Board of Directors.

Dividends from retained earnings applicable to the fiscal year

ended March 31, 2012 were as follows.

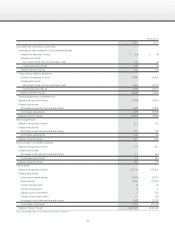

Date of resolution Total dividends

(Millions of yen)

Dividends per share

(Yen)

November 4, 2011

Resolution of the Board of

Directors

¥1,150 ¥10

May 18, 2012

Resolution of the Board of

Directors

2,301 20

6. Risk Factors

The Group identifies the items listed below as potential risk factors

that could affect operating results. Forward-looking statements are

in accordance with management’s judgment as of the submission

date of the securities filing.

(1) Changes in the Economic Environment

In the event of a harsh downturn in the economy causing consumer

expenditures to fall, demand for the Group’s products and services

in the entertainment field may decline. Such circumstances may

lead to adverse impact on the Group’s business performance.

(2) The Group’s Ability to Respond to Changes in Consumer

Preferences in the Digital Content Market and the Rapid

Progress of Innovative Technology

It is possible that the Group’s substantial transformation stated in

the “Medium- to Long-term Management Strategies and Challenges”

may adversely affect the Group’s business performance if the Group

is unable to respond adequately and promptly to such transformation.

(3) Changes in Game Platforms and the Group’s Response

The Group’s digital entertainment business could be affected by

diversification, the trend toward increasingly advanced functions

and the general transition of platforms for home-use video game

consoles, smartphones and everyday digital devices, which would

impact the way the Group supplies content, its business model and

profitability.

(4) Securing Human Resources to Execute the Group’s Growth

Strategies Concentrating on the Creation of New Content

and the Promotion of Global Businesses

The Group has been making rapid progress in expanding its

business operations. Delays in securing ideally suited human

resources may adversely affect the Group’s business performance.

(5) Expansion in the Group’s International Business

Operations

As the Group pursues expansion of its international business

operations, a variety of factors present in the countries and regions

in which the Group operates may affect its business performance.

Such factors include market trends, the political situation, economic

climate, laws and regulations, social conditions, cultural factors,

religious factors and customs.

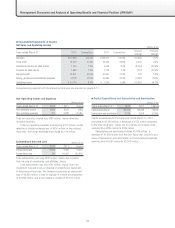

Management Discussion and Analysis of Operating Results and Financial Position (JPNGAAP)