Square Enix 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate Governance

directors’ remuneration, etc., are reviewed every year by

taking into account the business performance of the

Company for the fiscal year concerned and their contribution

to the business performance. To ensure the objectivity and

transparency of the annual review of directors’ remuneration,

the president of the Company determines the amount of

remuneration and the distribution among the directors within

the scope of the total remuneration amount approved by a

General Meeting of Shareholders in accordance with a

report by the Compensation Committee, an advisory body.

Stock options are determined by the Board of Directors,

also in accordance with a report by the Compensation

Committee.

The remuneration for corporate auditors is only monetary

compensation in light of the independence of corporate

auditors from the corporate management of the Company.

Corporate auditors’ remuneration is also reviewed every

year. The amount of remuneration and the distribution

among the corporate auditors are determined through

consultations among the corporate auditors within the scope

of the total remuneration amount approved by a General

Meeting of Shareholders.

(5) Matters relating to the Company’s holdings of

shares

Matters relating to shares held by the Company, which has

the largest balance-sheet value of investments in shares

within the Square Enix Group, are as follows:

(i) Number of companies in which shares are held and total

amount presented on the balance sheets for investments

in shares for purposes other than purely investment

purposes:

There are no applicable items.

(ii) Companies in which shares are held, investment category,

number of shares, amount presented on the balance

sheets and investment purpose for investments in shares

for purposes other than purely investment purposes:

There are no applicable items.

(iii) Total amount presented on balance sheets for the fiscal

years ended March 31, 2010 and March 31, 2011; and

total dividends received, total gain on sale of shares and

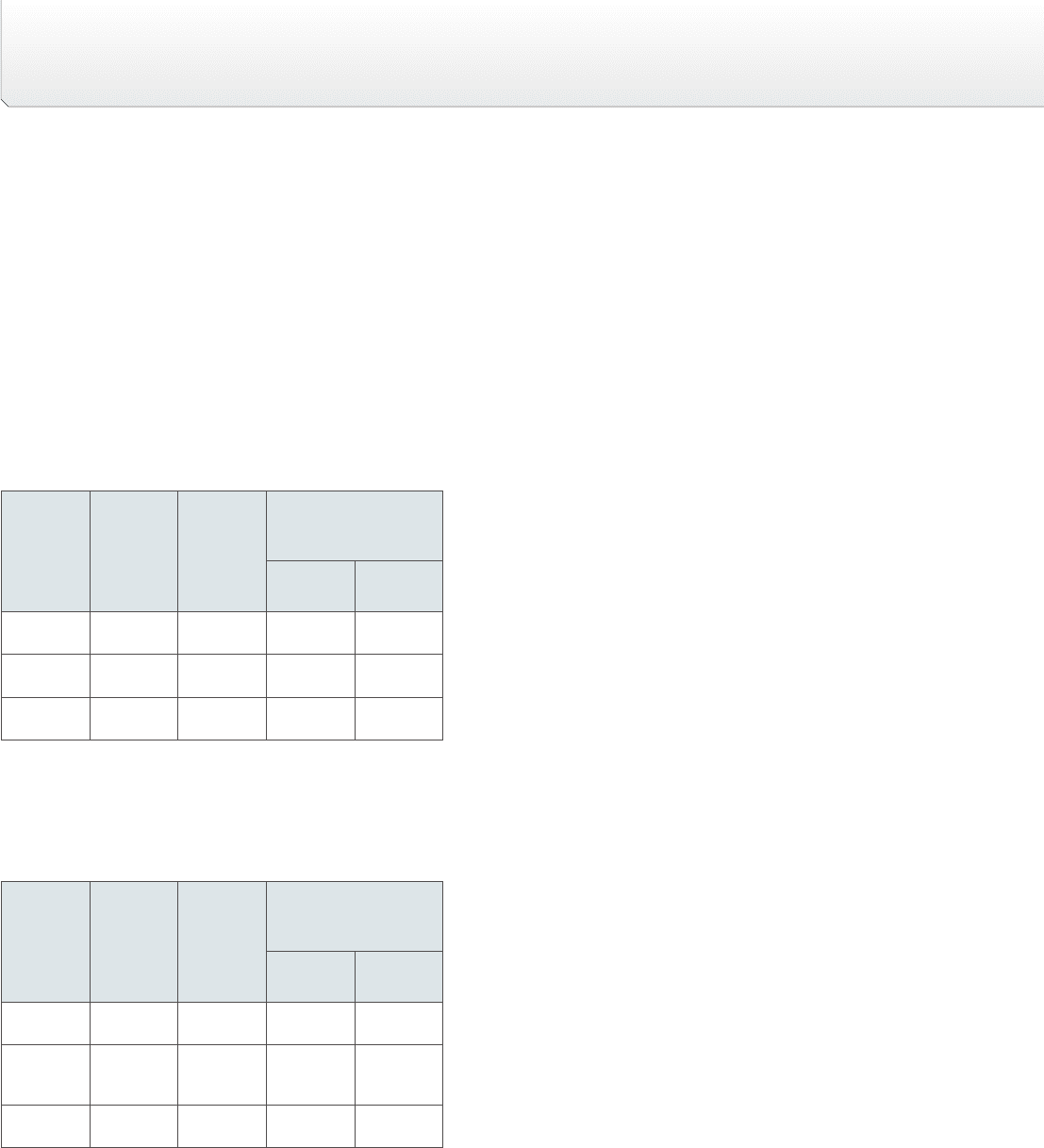

(4) Overview of compensation system for directors and

corporate auditors

(i) Total compensation paid to directors and corporate

auditors, total compensation for each category of director

and corporate auditor, and the total number of directors

and corporate auditors

Compensation Paid to Directors

Number of

individuals

Total

remuneration

(

Millions of yen

)

Remuneration

breakdown

(

Millions of yen

)

Monetary

compensation

Non-monetary

compensation

Directors 4 312 200 112

Outside

director 1761

Total 5 320 206 114

Notes: 1. Non-monetary compensation applicable to the fiscal year under review

was in the form of stock options.

2. The Company has abolished retirement benefits for directors and corporate

auditors.

Compensation Paid to Corporate Auditors

Number of

individuals

Total

remuneration

(

Millions of yen

)

Remuneration

breakdown

(

Millions of yen

)

Monetary

compensation

Non-monetary

compensation

Corporate

auditor 166—

Outside

corporate

auditors

32929—

Total 4 36 36 —

Note: Compensation for corporate auditors was determined as shown above after

taking into account corporate auditor independence in relation to the Company’s

management.

(ii) Decision-making policies on remuneration, etc., for

directors and corporate auditors

The remuneration for directors consists of monetary

compensation as a basic consideration and non-monetary

compensation such as stock options. The decisions on

16