Square Enix 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

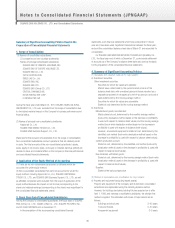

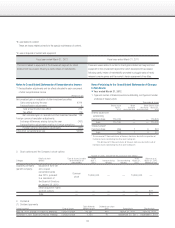

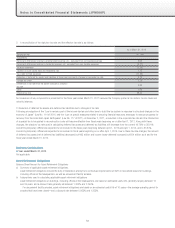

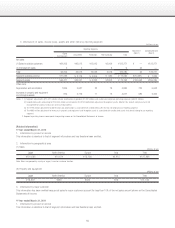

(3) Supplementary information regarding the fair value, and others,

of financial instruments

The fair value of financial instruments includes amounts based

on market prices as well as those calculated using an appropriate

formula when there is no applicable market price. Since variable

factors are included in the calculation of such fair values, the

adoption of different assumptions may lead to changes in these fair

value amounts.

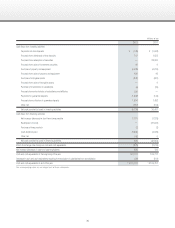

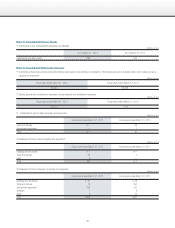

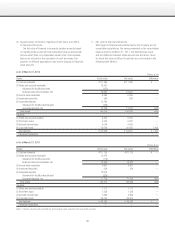

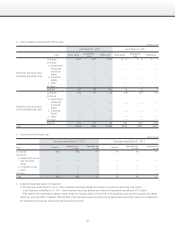

■ As of March 31, 2012

Millions of yen

Assets: Book value Fair value Difference

(1) Cash and deposits ¥111,495 ¥111,495 ¥ ─

(2) Notes and accounts receivable 18,431

Allowance for doubtful accounts (123)

Notes and accounts receivable, net 18,307 18,307 ─

(3) Income taxes receivable 6,396 6,396 ─

(4) Investment securities 549 549 ─

(5) Guarantee deposits 12,785

Allowance for doubtful deposits paid (526)

Guarantee deposits, net 12,259 11,614 (645)

Total assets 149,009 148,364 (645)

Liabilities:

(1) Notes and accounts payable 9,220 9,220 ─

(2) Short-term loans 5,253 5,253 ─

(3) Accrued income taxes 4,034 4,034 ─

(4) Corporate bonds 35,000 36,452 1,452

Total liabilities ¥ 53,509 ¥ 54,961 ¥ 1,452

Derivative transactions ─ ─ ─

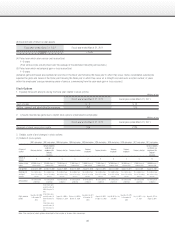

■ As of March 31, 2011

Millions of yen

Assets: Book value Fair value Difference

(1) Cash and deposits ¥111,126 ¥111,126 ¥ ─

(2) Notes and accounts receivable 15,474

Allowance for doubtful accounts (119)

Notes and accounts receivable, net 15,354 15,354 ─

(3) Income taxes receivable 6,907 6,907 ─

(4) Investment securities 334 334 ─

(5) Guarantee deposits 12,316

Allowance for doubtful deposits paid (526)

Guarantee deposits, net 11,790 11,335 (455)

Total assets 145,513 145,058 (455)

Liabilities:

(1) Notes and accounts payable 7,777 7,777 ─

(2) Short-term loans 1,338 1,338 ─

(3) Accrued income taxes 2,269 2,269 ─

(4) Corporate bonds 35,000 35,000 ─

Total liabilities ¥ 46,386 ¥ 46,386 ¥ ─

Derivative transactions ─ ─ ─

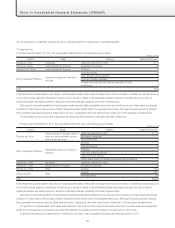

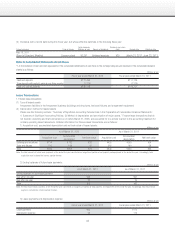

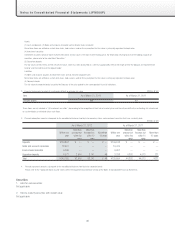

Notes: 1. Matters concerning the methods for estimating fair value and short-term investment securities

2. Fair value of financial instruments

With regard to financial instruments held by the Company and its

consolidated subsidiaries, the values presented on the consolidated

balance sheet as of March 31, 2011, the estimated fair value

and the difference between these amounts are as follows. Items

for which fair value is difficult to estimate are not included in the

following table (Note 2).