Square Enix 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders

In our dividend policy, we are mindful of the balance between

being performance-based and providing stable returns. In being

performance-based, we aim for a payout ratio of 30%. At the

same time, we advocate stable returns. Hence, we paid out

dividends of ¥30 per share in the fiscal year ended March 31,

2011, despite a net loss. We will pay dividends this fiscal year as

in previous years, and if we back calculate from the actual

payout ratio, earnings per share should be higher than ¥100.

We achieved a genuine recovery from the last fiscal year to

this fiscal year, but I realize that we have only completed half of

our objective.

Summary of Individual Business Segments

I’ll now review results by individual business segments.

Please take a look at the change in our operating income by

segments (Figure 1).

Compared to the prior fiscal year, the following segments

I am grateful to our shareholders for the opportunity to present

the Company’s annual report for the fiscal year ended March 31,

2012.

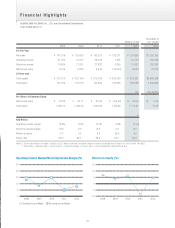

On a consolidated basis, net sales for the fiscal year ended

March 31, 2012 totaled ¥127,896 million (an increase of 2.1%

from the prior fiscal year), operating income totaled ¥10,713

million (an increase of 46.2%), recurring income totaled ¥10,297

million (an increase of 91.0%) and net income totaled ¥6,060

million (compared to a net loss of ¥12,043 million in the prior

fiscal year).

The Company’s operating income ratio was 8.4% and return

on equity (ROE) stood at 4.5%.

We set dividends applicable to the fiscal year ended March 31,

2012 at ¥30 per share (a consolidated payout ratio of 57.0%).

Yoichi Wada

President and Representative Director

02