SkyWest Airlines 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2013

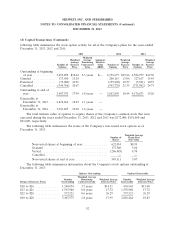

(8) Capital Transactions (Continued)

Taxes

A portion of the Company’s granted options qualify as incentive stock options (‘‘ISOs’’) for income

tax purposes. As such, a tax benefit is not recorded at the time the compensation cost related to the

options is recorded for book purposes due to the fact that an ISO does not ordinarily result in a tax

benefit unless there is a disqualifying disposition. Stock option grants of non-qualified options result in

the creation of a deferred tax asset, which is a temporary difference, until the time that the option is

exercised. Due to the treatment of incentive stock options for tax purposes, the Company’s effective tax

rate from year to year is subject to variability.

(9) Retirement Plans and Employee Stock Purchase Plans

SkyWest Retirement Plan

The Company sponsors the SkyWest, Inc. Employees’ Retirement Plan (the ‘‘SkyWest Plan’’).

Employees who have completed 90 days of service and are at least 18 years of age are eligible for

participation in the SkyWest Plan. Employees may elect to make contributions to the SkyWest Plan.

The Company matches 100% of such contributions up to 2%, 4% or 6% of the individual participant’s

compensation, based upon length of service. Additionally, a discretionary contribution may be made by

the Company. The Company’s combined contributions to the SkyWest Plan were $18.3 million,

$16.0 million and $14.4 million for the years ended December 31, 2013, 2012 and 2011, respectively.

ExpressJet and Atlantic Southeast Retirement Plan

ExpressJet (formerly Atlantic Southeast) sponsors the Atlantic Southeast Airlines, Inc. Investment

Savings Plan (the ‘‘Atlantic Southeast Plan’’). Employees who have completed 90 days of service and

are 18 years of age are eligible for participation in the Atlantic Southeast Plan. Employees may elect to

make contributions to the Atlantic Southeast Plan; however, ExpressJet limits the amount of company

match at 6% of each participant’s total compensation, except for those with ten or more years of

service whose company match is limited to 8% of total compensation. Additionally, ExpressJet matches

the individual participant’s contributions from 20% to 75%, depending on the length of the

participant’s service. Additionally, participants are 100% vested in their elective deferrals and rollover

amounts and from 10% to 100% vested in company matching contributions based on length of service.

Effective December 31, 2002, ExpressJet Delaware adopted the ExpressJet Airlines, Inc. 401(k)

Savings Plan (the ‘‘ExpressJet Retirement Plan’’). Substantially all of ExpressJet Delaware’s domestic

employees were covered by this plan at the time of the ExpressJet Combination. Effective January 1,

2009, the ExpressJet Retirement Plan was amended such that certain matching payment amounts have

been reduced or eliminated depending on the terms of the collective bargaining unit or work group, as

applicable.

ExpressJet’s contribution to the Atlantic Southeast and the ExpressJet Retirement Plans was

$26.7 million, $26.4 million and $25.1 million for the years ended December 31, 2013, 2012 and 2011,

respectively.

ExpressJet Delaware also provided medical bridge coverage for employees between the ages of 60

to 65, with at least ten years of service who have retired from the Company. In December 2007, the

93