SkyWest Airlines 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200

|

|

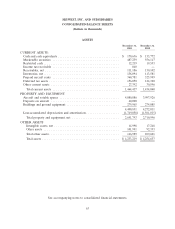

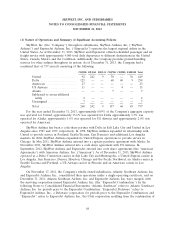

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2013

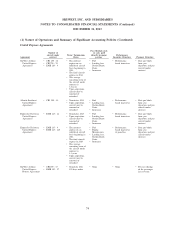

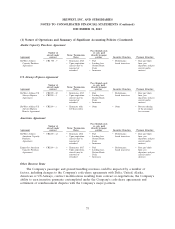

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

identification method, is recognized in other income and expense. The Company’s position in

marketable securities as of December 31, 2013 and 2012 was as follows (in thousands):

2013 2012

Investment Types Cost Market Value Cost Market Value

Commercial paper ............. $ — $ — $ 3,510 $ 3,514

Bond and bond funds .......... 489,071 489,294 555,603 556,133

Asset backed securities ......... 182 190 296 314

489,253 489,484 559,409 559,961

Unrealized appreciation ......... 231 — 552 —

Total ....................... 489,484 489,484 $559,961 $559,961

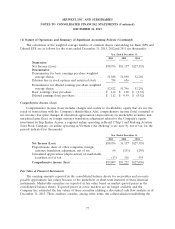

Marketable securities had the following maturities as of December 31, 2013 (in thousands):

Maturities Amount

Year 2014 ............................................... $304,353

Years 2015 through 2018 .................................... 182,873

Years 2019 through 2023 .................................... —

Thereafter ............................................... 2,258

As of December 31, 2013, the Company had classified $487.2 million of marketable securities as

short-term since it has the intent to maintain a liquid portfolio and the ability to redeem the securities

within one year. The Company has classified approximately $2.2 million of investments as non-current

and has identified them as ‘‘Other assets’’ in the Company’s consolidated balance sheet as of

December 31, 2013 (see Note 7).

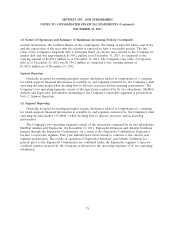

Inventories

Inventories include expendable parts, fuel and supplies and are valued at cost (FIFO basis) less an

allowance for obsolescence based on historical results and management’s expectations of future

operations. Expendable inventory parts are charged to expense as used. An obsolescence allowance for

flight equipment expendable parts is accrued based on estimated lives of the corresponding fleet types

and salvage values. The inventory allowance as of December 31, 2013 and 2012 was $10.1 million and

$9.2 million, respectively. These allowances are based on management estimates, which are subject to

change.

70