SkyWest Airlines 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

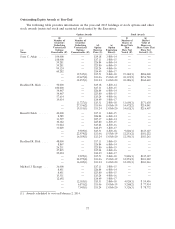

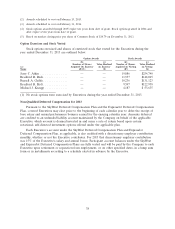

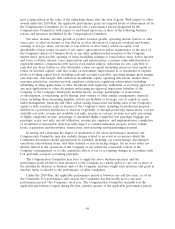

The following table provides information regarding the ExpressJet Deferred Compensation Plan

for Mr. Holt for 2013.

(e)

(b) (c) (d) Aggregate (f)

Executive Registrant Aggregate Withdrawals/ Aggregate

Contributions in Contributions in Earnings in Distributions in Balance at

(a) Last Year Last Year Last Year Last Year Last Year

Name ($) ($)(1) ($)(2) ($) End ($)

Bradford R. Holt ........... —$73,106 $19,752 — $374,200

(1) The amount in column (c) reflects the employer contributions credited in 2013 at the rate of 15%

of Mr. Holt’s 2013 base salary and 2012 bonus which was paid in 2013. The amount reported in

column (c) is also included in the amount reported in the ‘‘Other Compensation’’ column of the

Summary Compensation Table appearing above.

(2) The amounts in column (d) reflect the notational earnings during 2013 credited to Mr. Holt’s

account under the ExpressJet Deferred Compensation Plan. This amount is not reported in the

Summary Compensation Table because it is based on market rates determined by reference to

mutual funds that are available to participants in the ExpressJet 401(k) Plan or, in certain cases,

otherwise broadly available.

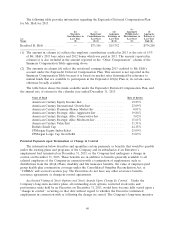

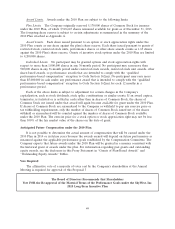

The table below shows the funds available under the ExpressJet Deferred Compensation Plan, and

the annual rate of return for the calendar year ended December 31, 2013:

Name of Fund Rate of Return

American Century Equity Income-Inst ........................ 19.83%

American Century International Growth-Inst ................... 23.09%

American Century Premium Money Market-Inv ................. 0.01%

American Century Strategic Alloc Aggressive-Inv ................ 19.84%

American Century Strategic Alloc Conservative-Inv .............. 3.02%

American Century Strategic Alloc Moderate-Inv ................. 15.61%

American Century Value-Inst .............................. 31.31%

Buffalo Small Cap ...................................... 44.15%

JPMorgan Equity Index-Select .............................. 25.09%

JPMorgan Large Cap Growth-R6 ........................... 33.03%

Potential Payments upon Termination or Change in Control

The information below describes and quantifies certain payments or benefits that would be payable

under the existing plans and programs of the Company and its subsidiaries if an Executive’s

employment had terminated on December 31, 2013, or the Company had undergone a change in

control on December 31, 2013. These benefits are in addition to benefits generally available to all

salaried employees of the Company in connection with a termination of employment, such as

distributions from the 401(k) Plans, disability and life insurance benefits, the value of employee-paid

group health plan continuation coverage under the Consolidated Omnibus Reconciliation Act, or

‘‘COBRA’’ and accrued vacation pay. The Executives do not have any other severance benefits,

severance agreements or change-in-control agreements.

Accelerated Vesting of Stock Options and Stock Awards Upon Change In Control. Under the

Company’s long-term incentive plans, all outstanding stock options, restricted stock units and

performance units held by an Executive on December 31, 2013, would have become fully vested upon a

‘‘change in control’’ occurring on that date without regard to whether the Executive terminated

employment in connection with or following the change in control. The Company’s long-term incentive

40