SkyWest Airlines 2013 Annual Report Download - page 66

Download and view the complete annual report

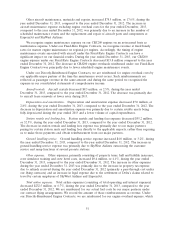

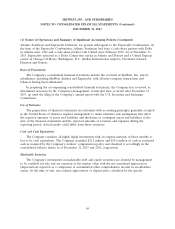

Please find page 66 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.rate notes may rise and increase the amount of interest expense. We would also receive higher amounts

of interest income on cash and securities held at the time; however, the market value of our

available-for-sale securities would likely decline. At December 31, 2013, we had variable rate notes

representing 29.5% of our total long-term debt compared to 31.7% of our long-term debt at

December 31, 2012. For illustrative purposes only, we have estimated the impact of market risk using a

hypothetical increase in interest rates of one percentage point for both variable rate long-term debt and

cash and securities. Based on this hypothetical assumption, we would have incurred an additional

$4.8 million in interest expense and received $6.7 million in additional interest income for the year

ended December 31, 2013, and we would have incurred an additional $5.5 million in interest expense

and received $6.5 million in additional interest income for the year ended December 31, 2012.

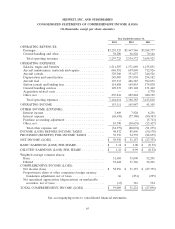

However, under our contractual arrangement with our major partners, the majority of the increase in

interest expense would be passed through and recorded as passenger revenue in our consolidated

statements of comprehensive income (loss). If interest rates were to decline, our major partners would

receive the principal benefit of the decline, since interest expense is generally passed through to our

major partners, resulting in a reduction to passenger revenue in our consolidated statement of

comprehensive income (loss).

We currently intend to finance the acquisition of aircraft through manufacturer financing,

third-party leases or long-term borrowings. Changes in interest rates may impact the actual cost to us

to acquire these aircraft. To the extent we place these aircraft in service under our code-share

agreements with Delta, United, or other carriers, our code-share agreements currently provide that

reimbursement rates will be adjusted higher or lower to reflect changes in our aircraft rental rates.

Auction Rate Securities

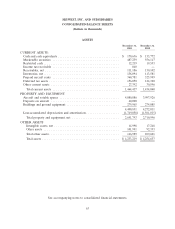

We have investments in auction rate securities, which are classified as available for sale securities

and reflected at fair value. As of December 31, 2013, we had investments in auction rate securities

valued at a total of $2.2 million which were classified as ‘‘Other Assets’’ on our consolidated balance

sheet. For a more detailed discussion on auction rate securities, including our methodology for

estimating their fair value, see Note 6 to our consolidated financial statements appearing in Item 8 of

this Report.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The information set forth below should be read together with the ‘‘Management’s Discussion and

Analysis of Financial Condition and Results of Operations,’’ appearing elsewhere herein.

61