SkyWest Airlines 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2013

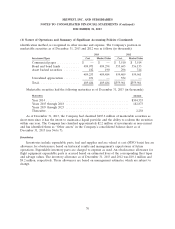

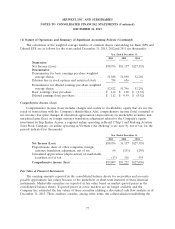

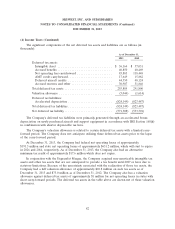

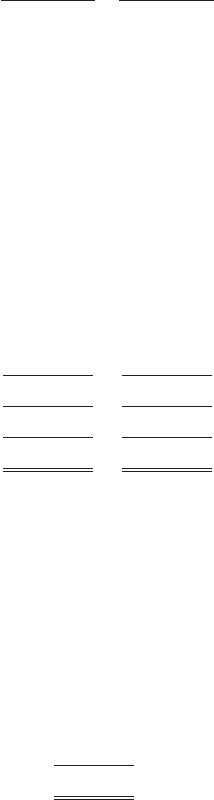

(3) Long-term Debt

Long-term debt consisted of the following as of December 31, 2013 and 2012 (in thousands):

December 31, December 31,

2013 2012

Notes payable to banks, due in semi-annual installments, variable interest

based on LIBOR, or with interest rates ranging from 1.34% to 2.55%

through 2014 to 2020, secured by aircraft ........................ $ 224,915 $ 273,515

Notes payable to a financing company, due in semi-annual installments,

variable interest based on LIBOR, or with interest rates ranging from

0.70% to 2.36% through 2014 to 2021, secured by aircraft ............ 392,660 434,716

Notes payable to banks, due in semi-annual installments plus interest at

6.06% to 7.18% through 2021, secured by aircraft .................. 149,477 168,937

Notes payable to a financing company, due in semi-annual installments plus

interest at 5.78% to 6.23% through 2019, secured by aircraft .......... 32,528 39,548

Notes payable to banks, due in monthly installments plus interest of 3.15%

to 8.18% through 2025, secured by aircraft ....................... 623,315 665,867

Notes payable to banks, due in semi-annual installments, plus interest at

6.05% through 2020, secured by aircraft ......................... 15,740 17,872

Notes payable to a bank, due in monthly installments interest based on

LIBOR plus interest at 2.00% to 4.00% through 2016, secured by aircraft . 31,933 41,567

Long-term debt ............................................. 1,470,568 1,642,022

Less current maturities ....................................... (177,389) (171,454)

Long-term debt, net of current maturities .......................... 1,293,179 1,470,568

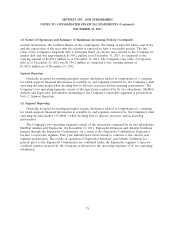

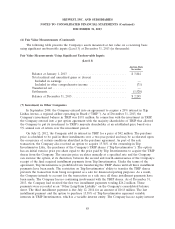

As of December 31, 2013, the Company had $1.5 billion of long-term debt obligations related to

the acquisition of CRJ200, CRJ700 and CRJ900 aircraft. The average effective interest rate on the debt

related to the CRJ aircraft was approximately 4.5% at December 31, 2013.

The aggregate amounts of principal maturities of long-term debt as of December 31, 2013 were as

follows (in thousands):

2014 .................................................. 177,389

2015 .................................................. 184,510

2016 .................................................. 188,240

2017 .................................................. 161,735

2018 .................................................. 139,020

Thereafter .............................................. 619,674

1,470,568

As of December 31, 2013 and 2012, SkyWest Airlines had a $25 million line of credit. As of

December 31, 2013 and 2012, SkyWest Airlines had no amount outstanding under the facility. The

facility expires on March 31, 2014 and has a variable interest rate of Libor plus 3.0%.

As of December 31, 2013, the Company had $88.5 million in letters of credit and surety bonds

outstanding with various banks and surety institutions.

As of December 31, 2013, the Company was in compliance with all debt covenants to which it was

subject.

80