SkyWest Airlines 2013 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

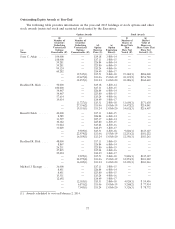

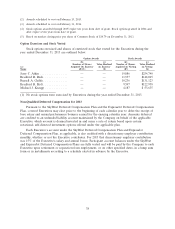

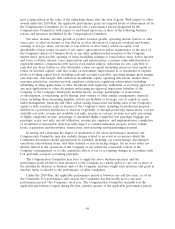

The following table provides information regarding the SkyWest Deferred Compensation Plan for

the Executives for the year ended December 31, 2013:

(e)

(b) (c) (d) Aggregate (f)

Executive Registrant Aggregate Withdrawals/ Aggregate

Contributions in Contributions in Earnings in Distributions in Balance at

(a) Last Year Last Year Last Year Last Year Last Year

Name(1) ($) ($)(2) ($)(3) ($) End ($)

SkyWest

Jerry C. Atkin ............ —$112,695 $607,388 — $3,073,134

Bradford R. Rich .......... —$ 86,381 $139,269 — $1,592,057

Russell A. Childs .......... — $ 73,494 $ 67,884 — $ 789,006

Bradford R. Holt .......... — $ 0 $ 31,474 — $ 473,190

Michael J. Kraupp ......... —$ 43,599 $197,343 — $ 850,409

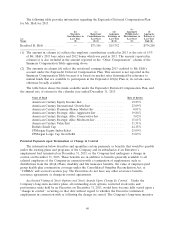

(1) For 2013, Messrs. Atkin, Rich, Childs and Kraupp were covered by the SkyWest Deferred

Compensation Plan only and Mr. Holt was covered by both the SkyWest Deferred Compensation

Plan (as to contributions for years prior to 2009 and earnings thereon only) and the ExpressJet

Deferred Compensation Plan (with respect to contributions for 2009 through 2013 and earnings

thereon).

(2) The amounts in column (c) reflect the amounts of employer contributions credited under the

applicable deferred compensation plan for 2013 at the rate of 15% of each Executive’s 2013 base

salary and 2012 bonus which was paid in 2013. The amounts reported in column (c) are also

included in the amounts reported in the ‘‘Other Compensation’’ column of the Summary

Compensation Table appearing above.

(3) The amounts in column (d) reflect the notational earnings during 2013 credited to each Executive’s

account under the SkyWest Deferred Compensation Plan. These amounts are not reported in the

Summary Compensation Table because they are based on market rates determined by reference to

mutual funds that are available to participants in the SkyWest 401(k) Plan or otherwise broadly

available.

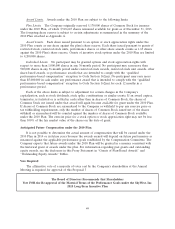

The table below shows the funds available for notational investment under the SkyWest Deferred

Compensation Plan, and the annual rate of return for the calendar year ended December 31, 2013:

Name of Fund Rate of Return

NVIT Money Market Fund Class I .......................... 0.00%

PIMCO VIT Total Return Admin ........................... ǁ1.96%

PIMCO VIT Real Return Admin ........................... ǁ9.44%

Invesco Van Kampen V.I. Growth & Income I .................. 34.08%

Dreyfus Stock Index Initial ................................ 32.03%

American Fund IS Growth 2 ............................... 30.10%

Nationwide NVIT Mid Cap Index I .......................... 33.05%

Fidelity VIP Mid Cap Svc ................................. 36.06%

AllianceBernstein VPS Small/Mid Cap Value A ................. 38.06%

Royce Capital Small Cap ................................. 34.75%

Ivy VIP Small Cap Growth ................................ 43.36%

MFS VIT II International Value Svc ......................... 27.63%

Invesco VIF International Growth I .......................... 19.01%

39