SkyWest Airlines 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ExpressJet United Express Agreements due to an uncured breach by SkyWest Airlines or ExpressJet of

certain operational or performance provisions, including measures and standards related to flight

completions, baggage handling and on-time arrivals. The current terms of the United CPA are subject

to certain early termination provisions and subsequent renewals. United may terminate the United CPA

due to an uncured breach by ExpressJet of certain operational and performance provisions, including

measures and standards related to flight completions and on-time arrivals.

We currently use the systems, facilities and services of Delta and United to support a significant

portion of our operations, including airport and terminal facilities and operations, information

technology support, ticketing and reservations, scheduling, dispatching, fuel purchasing and ground

handling services. If Delta or United were to cease any of these systems, close any of these facilities or

no longer provide these services to us, due to termination of one of our code-share agreements, a

strike or other labor interruption by Delta or United personnel or for any other reason, we may not be

able to replace those systems, facilities or services on terms and conditions as favorable as those we

currently receive, or at all. Since our revenues and operating profits are dependent on our level of

flight operations, we could then be forced to significantly reduce our operations. Furthermore, upon

certain terminations of our code-share agreements, Delta and United could require us to sell or assign

to them facilities and assets, including maintenance facilities, we use in connection with the code-share

services we provide. As a result, in order to offer airline service after termination of any of our

code-share agreements, we may have to replace these facilities, assets and services. We may be unable

to arrange such replacements on satisfactory terms, or at all.

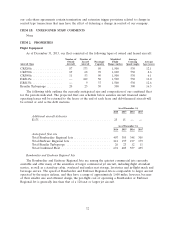

Maintenance costs will likely continue to increase as the age of our regional jet fleet increases.

The average age of our CRJ200s, ERJ145s, CRJ700s and CRJ900s is approximately 12.1 years,

12.0 years, 8.6 years and 6.1 years respectively. All of the parts on these aircraft are no longer under

warranty and we have started to incur more heavy airframe inspections and engine overhauls on those

aircraft. Our non-engine maintenance costs are expected to continue to increase on our CRJ200,

ERJ145, CRJ700 and CRJ900 fleets. Our-non engine maintenance costs will increase significantly, both

on an absolute basis and as a percentage of our operating expenses, as our fleet ages. If our

maintenance costs increase at a higher rate than amounts we can recover in revenue, we will have a

negative impact on our financial results.

We may be negatively impacted if Delta or United experiences significant financial difficulties in the future.

For the year ended December 31, 2013 approximately 94.5% of the available seat miles (‘‘ASMs’’)

generated in our operations were attributable to our code-share agreements with Delta and United. If

Delta or United experiences significant financial difficulties, we would likely be negatively affected. For

example, volatility in fuel prices may negatively impact Delta’s and United’s results of operations and

financial condition. Among other risks, Delta and United are vulnerable both to unexpected events

(such as additional terrorist attacks or additional spikes in fuel prices) and to deterioration of the

operating environment (such as a recession or significant increased competition). There is no assurance

that Delta or United will be able to operate successfully under these financial conditions.

In light of the importance of our code-share agreements with Delta and United to our business, a

default by Delta or United under any of these agreements, or the termination of these agreements

could jeopardize our operations. Such events could leave us unable to operate many of our current

aircraft, as well as additional aircraft we are obligated to purchase, which would likely result in a

material adverse effect on our operations and financial condition.

The financial condition of Delta and United will continue to pose risks for our operations. Serial

bankruptcies are not unprecedented in the commercial airline industry, and Delta and/or United could

file for bankruptcy, in which case our code-share agreements could be subject to termination under the

22