SkyWest Airlines 2013 Annual Report Download - page 149

Download and view the complete annual report

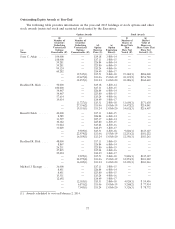

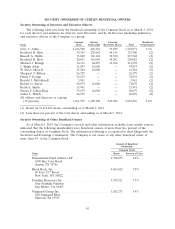

Please find page 149 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(5) All other compensation for Mr. Atkin for 2012 consists of $88,920 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2012; $3,918 in employer-paid health insurance

premiums; $15,858 for a personal vehicle lease; $5,309 for personal use of the Company’s recreational equipment;

and $1,178 in discretionary matching contributions under the SkyWest 401(k) Plan.

(6) All other compensation for Mr. Atkin for 2011 consists of $103,157 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2011; $1,436 in employer-paid health insurance

premiums; $18,541 for a personal vehicle lease; $2,855 for personal use of the Company’s recreational equipment;

and $612 in discretionary matching contributions under the SkyWest 401(k) Plan.

(7) All other compensation for Mr. Rich for 2013 consists of: $86,381 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2013; $5,195 in employer-paid health insurance

premiums; $14,760 for a personal vehicle allowance; $4,362 for personal use of the Company’s recreational

equipment; and $1,580 in discretionary matching contributions under the SkyWest 401(k) Plan.

(8) All other compensation for Mr. Rich for 2012 consists of: $68,810 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2012; $5,103 in employer-paid health insurance

premiums; $14,760 for a personal vehicle allowance; $5,309 for personal use of the Company’s recreational

equipment; and $1,250 in discretionary matching contributions under the SkyWest 401(k) Plan.

(9) All other compensation for Mr. Rich for 2011 consists of: $78,064 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2011; $1,994 in employer-paid health insurance

premiums; $14,270 for a personal vehicle allowance; $2,855 for personal use of the Company’s recreational

equipment; and $674 in discretionary matching contributions under the SkyWest 401(k) Plan.

(10) All other compensation for Mr. Childs for 2013 consists of: $73,494 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2013; $5,195 in employer-paid health insurance

premiums; $15,727 for a personal vehicle lease; $4,362 for personal use of the Company’s recreational equipment;

and $1,599 in discretionary matching contributions under the SkyWest 401(k) Plan.

(11) All other compensation for Mr. Childs for 2012 consists of: $63,859 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2012; $5,103 in employer-paid health insurance

premiums; $14,727 for a personal vehicle lease; $5,309 for personal use of the Company’s recreational equipment;

and $1,250 in discretionary matching contributions under the SkyWest 401(k) Plan.

(12) All other compensation for Mr. Childs for 2011 consists of: $69,454 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2011; $1,994 in employer-paid health insurance

premiums; $14,283 for a personal vehicle lease; $2,855 for personal use of the Company’s recreational equipment;

and $593 in discretionary matching contributions under the SkyWest 401(k) Plan.

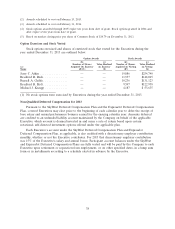

(13) All other compensation for Mr. Holt for 2013 consists of: $73,106 of employer credits under the ExpressJet

Deferred Compensation Plan attributable to compensation earned for 2013; $5,050 in employer-paid health

insurance premiums; $13,800 for a personal vehicle lease; and $4,362 for personal use of the Company’s recreational

equipment.

(14) All other compensation for Mr. Holt for 2012 consists of: $54,111 of employer credits under the ExpressJet

Deferred Compensation Plan attributable to compensation earned for 2012; $4,964 in employer-paid health

insurance premiums; $13,800 for a personal vehicle lease; and $5,309 for personal use of the Company’s recreational

equipment.

(15) All other compensation for Mr. Holt for 2011 consists of: $61,917 of employer credits under the ExpressJet

Deferred Compensation Plan attributable to compensation earned for 2011; $1,949 in employer-paid health

insurance premiums; $13,800 for a personal vehicle lease; and $2,855 for personal use of the Company’s recreational

equipment.

(16) All other compensation for Mr. Kraupp for 2013 consists of: $43,599 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2013; $5,195 in employer-paid health

insurance premiums; $4,362 for personal use of the Company’s recreational equipment; and $1,599 in discretionary

matching contributions under the SkyWest 401(k) Plan.

(17) All other compensation for Mr. Kraupp for 2012 consists of: $41,273 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2012; $5,103 in employer-paid health

insurance premiums; $5,309 for personal use of the Company’s recreational equipment; and $1,108 in discretionary

matching contributions under the SkyWest 401(k) Plan.

(18) All other compensation for Mr. Kraupp for 2011 consists of: $39,543 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2011; $1,994 in employer-paid health

insurance premiums; $2,855 for personal use of the Company’s recreational equipment; and $531 in discretionary

matching contributions under the SkyWest 401(k) Plan.

35