SkyWest Airlines 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2013

(4) Income Taxes (Continued)

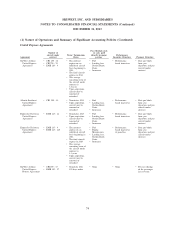

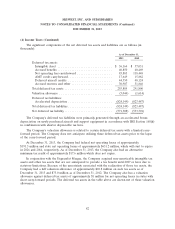

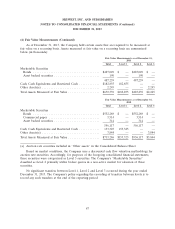

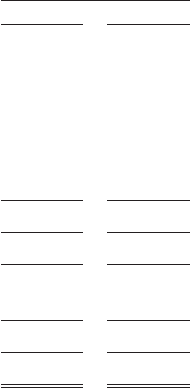

The significant components of the net deferred tax assets and liabilities are as follows (in

thousands):

As of December 31,

2013 2012

Deferred tax assets:

Intangible Asset ............................... $ 36,164 $ 37,031

Accrued benefits ............................... 40,850 40,469

Net operating loss carryforward .................... 85,885 118,448

AMT credit carryforward ......................... 17,649 15,882

Deferred aircraft credits ......................... 44,350 48,124

Accrued reserves and other ....................... 30,987 31,846

Total deferred tax assets ........................... 255,885 291,800

Valuation allowance .............................. (3,044) (1,614)

Deferred tax liabilities:

Accelerated depreciation ......................... (824,149) (823,487)

Total deferred tax liabilities ......................... (824,149) (823,487)

Net deferred tax liability ........................... (571,308) (533,301)

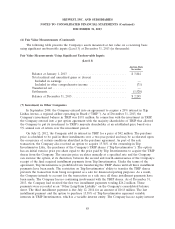

The Company’s deferred tax liabilities were primarily generated through an accelerated bonus

depreciation on newly purchased aircraft and support equipment in accordance with IRS Section 168(k)

in combination with shorter depreciable tax lives.

The Company’s valuation allowance is related to certain deferred tax assets with a limited carry-

forward period. The Company does not anticipate utilizing these deferred tax assets prior to the lapse

of the carry-forward period.

At December 31, 2013, the Company had federal net operating losses of approximately

$191.5 million and state net operating losses of approximately $651.2 million, which will start to expire

in 2026 and 2014, respectively. As of December 31, 2013, the Company also had an alternative

minimum tax credit of approximately $17.6 million which does not expire.

In conjunction with the ExpressJet Merger, the Company acquired non-amortizable intangible tax

assets and other tax assets that are not anticipated to provide a tax benefit until 2027 or later due to

statutory limitations. Because of the uncertainty associated with the realization of those tax assets, the

Company had a full valuation allowance of approximately $69.8 million on such tax assets as of

December 31, 2013 and $73.0 million as of December 31, 2012. The Company also has a valuation

allowance against deferred tax assets of approximately $1 million for net operating losses in states with

short carry-forward periods. The deferred tax assets in the table above are shown net of these valuation

allowances.

82