SkyWest Airlines 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2013

(5) Commitments and Contingencies (Continued)

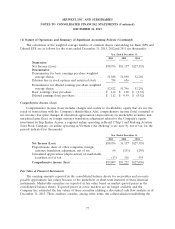

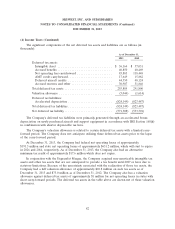

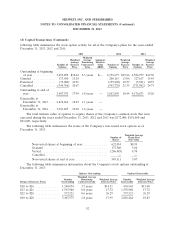

Accordingly, the following table refers to ExpressJet’s employee groups based upon their union

affiliations prior to the ExpressJet Combination.

Approximate

Number of

Active Employees Status of

Employee Group Represented Representatives Agreement

Atlantic Southeast Pilots ........ 1,800 Air Line Pilots Association International Amendable

Atlantic Southeast Flight Attendants 1,075 International Association of Machinists Amendable

and Aerospace Workers

Atlantic Southeast Flight

Controllers ................ 60 Transport Workers Union of America Amendable

Atlantic Southeast Mechanics ..... 700 International Brotherhood of Teamsters Amendable

Atlantic Southeast Stock Clerks . . . 70 International Brotherhood of Teamsters Amendable

ExpressJet Delaware Pilots ....... 2,900 Air Line Pilots Association International Amendable

ExpressJet Delaware Flight

Attendants ................ 1,200 International Association of Machinists Amendable

and Aerospace Workers

ExpressJet Delaware Mechanics . . . 1,000 International Brotherhood of Teamsters Amendable

ExpressJet Delaware Dispatchers . . 85 Transport Workers Union of America Amendable

ExpressJet Delaware Stock Clerks . . 100 International Brotherhood of Teamsters Amendable

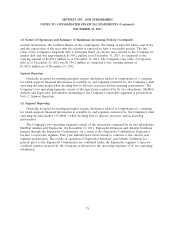

During December 2013, the Airline Pilots Association International (‘‘ALPA’’), which represents the

Atlantic Southeast pilot and ExpressJet Delaware pilot groups, conducted a vote of the two employee

groups, seeking approval of a joint collective bargaining agreement that ExpressJet had negotiated with

ALPA representatives. The two employee groups rejected the joint collective bargaining agreement,

which resulted in the agreements with those employee groups remaining amendable as indicated in the

foregoing table. The decision of those employee groups to reject the joint collective bargaining

agreement will preclude us from realizing some of the savings we had hoped to achieve through the

ExpressJet Combination. ExpressJet intends to resume negotiations with ALPA in an effort to negotiate

an acceptable agreement.

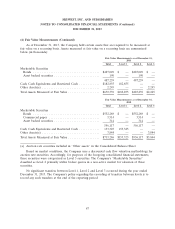

(6) Fair Value Measurements

The Company holds certain assets that are required to be measured at fair value in accordance

with United States GAAP. The Company determined fair value of these assets based on the following

three levels of inputs:

Level 1—Quoted prices in active markets for identical assets or liabilities.

Level 2—Observable inputs other than Level 1 prices such as quoted prices for

similar assets or liabilities; quoted prices in markets that are not active; or

other inputs that are observable or can be corroborated by observable

market data for substantially the full term of the assets or liabilities. Some

of the Company’s marketable securities primarily utilize broker quotes in a

non-active market for valuation of these securities.

Level 3—Unobservable inputs that are supported by little or no market activity and

that are significant to the fair value of the assets or liabilities, therefore

requiring an entity to develop its own assumptions.

86