SkyWest Airlines 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

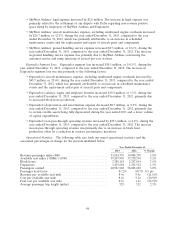

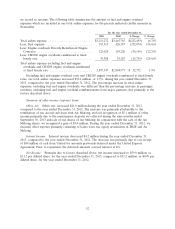

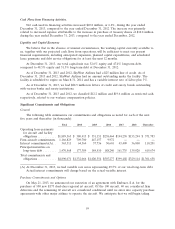

we record as revenue. The following table summarizes the amount of fuel and engine overhaul

expenses which are included in our total airline expenses for the periods indicated (dollar amounts in

thousands).

For the year ended December 31,

2013 2012 $ Change % Change

Total airline expense ......................... $3,213,272 $3,445,765 $(232,493) (6.7)%

Less: Fuel expense .......................... 193,513 426,387 (232,874) (54.6)%

Less: Engine overhauls Directly-Reimbursed Engine

Contracts ............................... 123,024 159,220 (36,196) (22.7)%

Less: CRJ200 engine overhauls reimbursed at fixed

hourly rate .............................. 39,388 55,183 (15,795) (28.6)%

Total airline expense excluding fuel and engine

overhauls and CRJ200 engine overhauls reimbursed

at fixed hourly rate ........................ 2,857,347 $2,804,975 $ 52,372 1.9%

Excluding fuel and engine overhaul costs and CRJ200 engine overhauls reimbursed at fixed hourly

rates, our total airline expenses increased $52.4 million, or 1.9%, during the year ended December 31,

2013, compared to the year ended December 31, 2012. The percentage increase in total airline

expenses, excluding fuel and engine overhauls, was different than the percentage increase in passenger

revenues, excluding fuel and engine overhaul reimbursements from major partners, due primarily to the

factors described above.

Summary of other income (expense) items:

Other, net. Other, net, increased $21.0 million during the year ended December 31, 2013,

compared to the year ended December 31, 2012. The increase was primarily attributable to the

termination of our aircraft sub-lease with Air Mekong, and our recognition of $5.1 million of other

income primarily due to the maintenance deposits we collected during the nine months ended

September 30, 2013 and sale of our shares of Air Mekong. In conjunction with the sale of the Air

Mekong shares, we recognized a gain of $5.0 million. During the year ended December 31, 2012, we

incurred other expense primarily consisting of losses from our equity investments in TRIP and Air

Mekong.

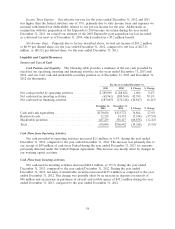

Interest Income. Interest income decreased $4.2 million during the year ended December 31,

2013, compared to the year ended December 31, 2012. The decrease was primarily due to our receipt

of $49 million of cash from United for amounts previously deferred under the United Express

Agreement. Prior to repayment, the deferred amounts accrued interest at 8%.

Net Income. Primarily due to factors described above, net income increased to $59.0 million, or

$1.12 per diluted share, for the year ended December 31, 2013, compared to $51.2 million, or $0.99 per

diluted share, for the year ended December 31, 2012.

52