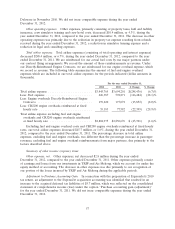

SkyWest Airlines 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.delivery of these aircraft in March 2014 and have scheduled delivery of the remaining aircraft covered

by the order through August 2015.

We have not historically funded a substantial portion of our aircraft acquisitions with working

capital. Rather, we have generally funded our aircraft acquisitions through a combination of operating

leases and long-term debt financing. At the time of each aircraft acquisition, we evaluate the financing

alternatives available to us, and select one or more of these methods to fund the acquisition. At

present, we intend to fund our acquisition of any additional aircraft through a combination of operating

leases and debt financing, consistent with our historical practices. Based on current market conditions

and discussions with prospective leasing organizations and financial institutions, we currently believe

that we will be able to obtain financing for our committed acquisitions, as well as additional aircraft,

without materially reducing the amount of working capital available for our operating activities.

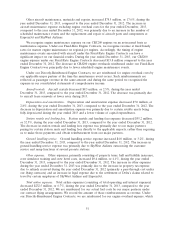

Aircraft Lease and Facility Obligations

We also have significant long-term lease obligations, primarily relating to our aircraft fleet. At

December 31, 2013, we had 570 aircraft under lease with remaining terms ranging from one to

12 years. Future minimum lease payments due under all long-term operating leases were approximately

$1.9 billion at December 31, 2013. Assuming a 5.8% discount rate, which is the average rate used to

approximate the implicit rates within the applicable aircraft leases, the present value of these lease

obligations would have been equal to approximately $1.5 billion at December 31, 2013.

Long-term Debt Obligations

As of December 31, 2013, we had $1.5 billion of long-term debt obligations related to the

acquisition of CRJ200, CRJ700 and CRJ900 aircraft. The average effective interest rate on the debt

related to the CRJ aircraft was approximately 4.5% at December 31, 2013.

Guarantees

We have guaranteed the obligations of SkyWest Airlines under the SkyWest Airlines Delta

Connection Agreement and the obligations of ExpressJet under the ExpressJet Delta Connection

Agreement. We have also guaranteed the obligations of ExpressJet under the United CPA.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

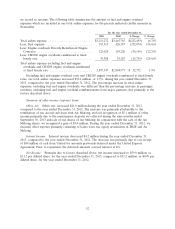

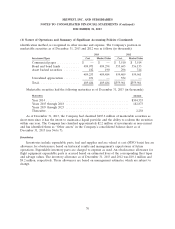

Aircraft Fuel

In the past, we have not experienced difficulties with fuel availability and we currently expect to be

able to obtain fuel at prevailing prices in quantities sufficient to meet our future needs. Pursuant to our

contract flying arrangements, United, Delta, Alaska, American and US Airways have agreed to bear the

economic risk of fuel price fluctuations on our contracted flights. We bear the economic risk of fuel

price fluctuations on our pro-rate operations. For the year ended December 31, 2013, approximately

3% of our ASMs were flown under pro-rate arrangements. The average price per gallon of aircraft fuel

decreased 3.9% to $3.45 for the year ended December 31, 2013, from $3.59 for the year ended

December 31, 2012. For illustrative purposes only, we have estimated the impact of the market risk of

fuel on our pro-rate operations using a hypothetical increase of 25% in the price per gallon we

purchase. Based on this hypothetical assumption, we would have incurred an additional $25.3 million in

fuel expense for the year ended December 31, 2013.

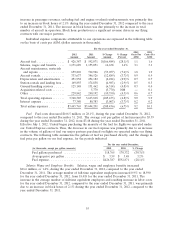

Interest Rates

Our earnings are affected by changes in interest rates due to the amounts of variable rate

long-term debt and the amount of cash and securities held. The interest rates applicable to variable

60