SkyWest Airlines 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2011

(10) Capital Transactions (Continued)

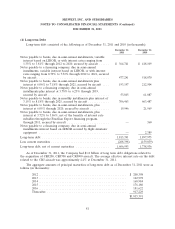

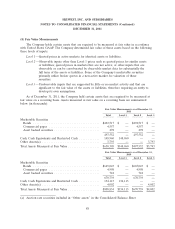

Incentive Plan. The following table shows the assumptions used and weighted average fair value for

grants in the years ended December 31, 2011, 2010 and 2009.

2011 2010 2009

Expected annual dividend rate ..................... 1.04% 1.10% 1.05%

Risk-free interest rate ........................... 2.08% 1.88% 1.67%

Average expected life (years) ...................... 5.8 4.6 4.6

Expected volatility of common stock ................ 0.404 0.402 0.351

Forfeiture rate ................................ 0.0% 0.0% 1.0%

Weighted average fair value of option grants .......... $ 5.74 $ 4.78 $ 4.42

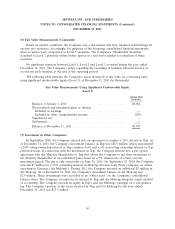

The Company recorded share-based compensation expense only for those options that are

expected to vest. The estimated fair value of the stock options is amortized over the vesting period of

the respective stock option grants.

During the year ended December 31, 2011, the Company granted 222,681 shares of restricted stock

to the Company’s employees under the 2010 Incentive Plan. The restricted stock has a three-year

vesting period, during which the recipient must remain employed with the Company or its subsidiaries.

The weighted average fair value of the restricted stock on the date of grants made during the year

ended December 31, 2011 was $15.51 per share. Additionally, the Company granted 26,821 fully-vested

shares of common stock to the Company’s directors with a weighted average grant-date fair value of

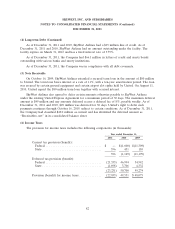

$15.51. The following table summarizes the restricted stock activity as of December 31, 2011, 2010 and

2009:

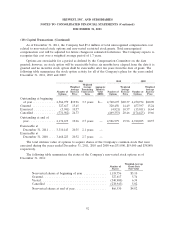

Weighted-Average

Number of Grant-Date

Shares Fair Value

Non-vested shares outstanding at December 31, 2008 . . . 755,127 $25.50

Granted .................................... 227,451 15.24

Vested ..................................... (260,575) 22.94

Cancelled ................................... (35,417) 24.10

Non-vested shares outstanding at December 31, 2009 . . . 686,586 $23.13

Granted .................................... 248,384 14.49

Vested ..................................... (256,285) 25.51

Cancelled ................................... (19,422) 21.68

Non-vested shares outstanding at December 31, 2010 . . . 659,263 18.97

Granted .................................... 249,502 15.51

Vested ..................................... (238,848) 25.80

Cancelled ................................... (58,315) 15.71

Non-vested shares outstanding at December 31, 2011 . . . 611,602 15.08

During the year ended December 31, 2011, 2010 and 2009, the Company recorded equity-based

compensation expense of $5.4 million, $6.4 million and $7.9 million, respectively.

91