SkyWest Airlines 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2011

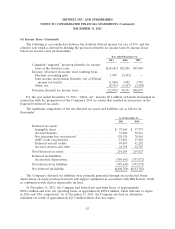

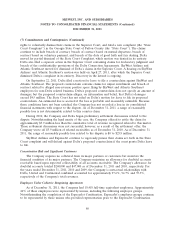

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

New Accounting Standards

Fair Value Measurement and Disclosure Requirements

In May 2011, the FASB issued ‘‘Amendments to Achieve Common Fair Value Measurement and

Disclosure Requirements in U.S. GAAP and IFRSs.’’ The standard revises guidance for fair value

measurement and expands the disclosure requirements. It is effective prospectively for fiscal years

beginning after December 15, 2011. The Company does not anticipate that the adoption of this

standard will have a material impact on its consolidated financial statements.

Presentation of Comprehensive Income

In June 2011, the FASB issued ‘‘Presentation of Comprehensive Income.’’ The standard revises the

presentation and prominence of the items reported in other comprehensive income. It is effective

retrospectively for fiscal years beginning after December 15, 2011, with early adoption permitted. The

Company intends to adopt this standard for the quarter ending March 31, 2012. The Company does

not anticipate that the adoption of this standard will have a material impact on its consolidated

financial statements.

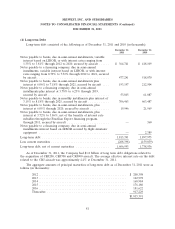

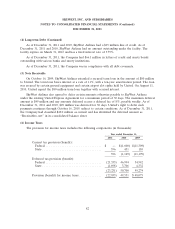

(2) ExpressJet Merger

On November 12, 2010, the Company acquired ExpressJet Delaware through the merger of

ExpressJet Holdings, Inc., the sole shareholder of ExpressJet Delaware (‘‘ExpressJet Holdings’’), with a

wholly-owned subsidiary of Atlantic Southeast (the ‘‘ExpressJet Merger’’). As a result of the ExpressJet

Merger, each issued and outstanding share of ExpressJet Holdings common stock (other than shares

owned by ExpressJet Holdings as treasury stock or shares owned by the Company or any of its

subsidiaries) was converted into the right to receive $6.75 per share in cash, payable to the holder

thereof, without interest. Based on the number of outstanding shares of ExpressJet Holdings common

stock as of the effective time of the ExpressJet Merger, the aggregate value of the Merger

consideration was $131.6 million. After taking in effect the number of shares acquired by the Company

and its subsidiaries prior to the effective time, the aggregate value of the ExpressJet Merger

consideration was $136.5 million.

In connection with the ExpressJet Merger, ExpressJet Delaware and Continental entered into the

Continental CPA, whereby ExpressJet Delaware (now ExpressJet) agreed to provide regional airline

services in the Continental flight system. The Continental CPA became effective on November 12, 2010.

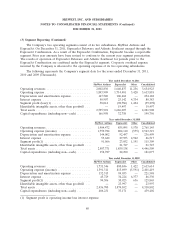

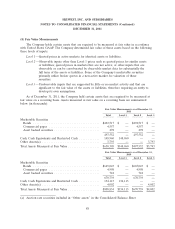

The Company accounted for the ExpressJet Merger in accordance with FASB ASC Topic 805,

Business Combinations, whereby the tangible assets acquired and liabilities assumed from ExpressJet

Holdings are recorded based on their estimated fair values as of the closing date. The revenues of

ExpressJet Delaware represented 4% of the Company’s total revenues for the year ended

December 31, 2010. The following table reflects the aggregate consideration and estimated fair values

of the tangible assets acquired and liabilities assumed (including the attribution of ExpressJet Holdings

liabilities to the purchase price, since those liabilities remained the obligation of ExpressJet Holdings

78