SkyWest Airlines 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

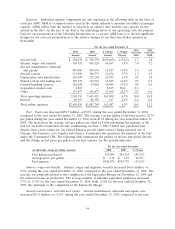

Aircraft Fuel

In the past, we have not experienced difficulties with fuel availability and we currently expect to be

able to obtain fuel at prevailing prices in quantities sufficient to meet our future needs. Pursuant to our

contract flying arrangements, United and Continental have agreed to bear the economic risk of fuel

price fluctuations on our contracted United Express and Continental Express flights. On our Delta

Connection regional jet flights, Delta has agreed to bear the economic risk of fuel price fluctuations.

We bear the economic risk of fuel price fluctuations on our pro-rate operations. As of December 31,

2011, essentially all of our Brasilia turboprops flown for Delta were flown under pro-rate arrangements

while, approximately 61% of our Brasilia turboprops flown in the United system were flown under

pro-rate arrangements. As of December 31, 2011, we operated 17 CRJ200s for United under a pro-rate

agreement. The average price per gallon of aircraft fuel increased 27.0% to $3.48 for the year ended

December 31, 2011, from $2.74 for the year ended December 31, 2010. For illustrative purposes only,

we have estimated the impact of the market risk of fuel on our pro-rate operations using a hypothetical

increase of 25% in the price per gallon we purchase. Based on this hypothetical assumption, we would

have incurred an additional $25.0 million in fuel expense for the year ended December 31, 2011.

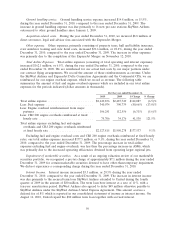

Interest Rates

Our earnings are affected by changes in interest rates due to the amounts of variable rate

long-term debt and the amount of cash and securities held. The interest rates applicable to variable

rate notes may rise and increase the amount of interest expense. We would also receive higher amounts

of interest income on cash and securities held at the time; however, the market value of our

available-for-sale securities would likely decline. At December 31, 2011, we had variable rate notes

representing 33.0% of our total long-term debt compared to 36.0% of our long-term debt at

December 31, 2010. For illustrative purposes only, we have estimated the impact of market risk using a

hypothetical increase in interest rates of one percentage point for both variable rate long-term debt and

cash and securities. Based on this hypothetical assumption, we would have incurred an additional

$7.1 million in interest expense and received $6.4 million in additional interest income for the year

ended December 31, 2011, and we would have incurred an additional $7.2 million in interest expense

and received $7.7 million in additional interest income for the year ended December 31, 2010.

However, under our contractual arrangement with our major partners, the majority of the increase in

interest expense would be passed through and recorded as passenger revenue in our consolidated

statements of income. If interest rates were to decline, our major partners would receive the principal

benefit of the decline, since interest expense is generally passed through to our major partners,

resulting in a reduction to passenger revenue in our consolidated statement of income.

We currently intend to finance the acquisition of aircraft through manufacturer financing, third-

party leases or long-term borrowings. Changes in interest rates may impact the actual cost to us to

acquire these aircraft. To the extent we place these aircraft in service under our code-share agreements

with Delta, United, Continental or other carriers, our code-share agreements currently provide that

reimbursement rates will be adjusted higher or lower to reflect changes in our aircraft rental rates.

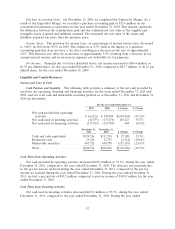

Auction Rate Securities

We have investments in auction rate securities, which are classified as available for sale securities

and reflected at fair value. Due primarily to instability in credit markets over the past three years, we

sold a portion of these investments. As of December 31, 2011, we had investments valued at a total of

$3.8 million which were classified as Other assets on our consolidated balance sheet. For a more

detailed discussion on auction rate securities, including our methodology for estimating their fair value,

see Note 8 to our consolidated financial statements appearing in Item 8 of this Report.

60