SkyWest Airlines 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2011

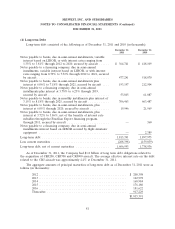

(4) Long-term Debt (Continued)

As of December 31, 2011 and 2010, SkyWest Airlines had a $25 million line of credit. As of

December 31, 2011 and 2010, SkyWest Airlines had no amount outstanding under the facility. The

facility expires on March 31, 2012 and has a fixed interest rate of 3.79%.

As of December 31, 2011, the Company had $66.1 million in letters of credit and surety bonds

outstanding with various banks and surety institutions.

As of December 31, 2011, the Company was in compliance with all debt covenants.

(5) Note Receivable

On October 16, 2009, SkyWest Airlines extended a secured term loan in the amount of $80 million

to United. The term loan bears interest at a rate of 11%, with a ten-year amortization period. The loan

was secured by certain ground equipment and certain airport slot rights held by United. On August 11,

2010, United repaid the $80 million term loan together with accrued interest.

SkyWest Airlines also agreed to defer certain amounts otherwise payable to SkyWest Airlines

under the existing United Express Agreement for a maximum period of 30 days. The maximum deferral

amount is $49 million and any amounts deferred accrue a deferral fee of 8%, payable weekly. As of

December 31, 2011 and 2010, $49 million was deferred for 30 days. United’s right to defer such

payments continues through October 16, 2019, subject to certain conditions. As of December 31, 2011,

the Company had classified $49.0 million as current and has identified the deferred amount as

‘‘Receivables, net’’ in its consolidated balance sheet.

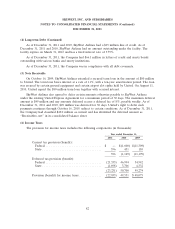

(6) Income Taxes

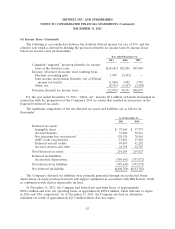

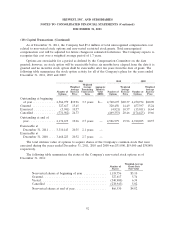

The provision for income taxes includes the following components (in thousands):

Year ended December 31,

2011 2010 2009

Current tax provision (benefit):

Federal ................................ $ — $(1,600) $(11,309)

State .................................. 396 451 110

396 (1,149) (11,199)

Deferred tax provision (benefit):

Federal ................................ (21,533) 46,994 54,942

State .................................. (1,698) 3,706 4,332

(23,231) 50,700 59,274

Provision (benefit) for income taxes ............. (22,835) 49,551 $ 48,075

82