SkyWest Airlines 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2011

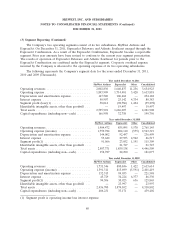

(2) ExpressJet Merger (Continued)

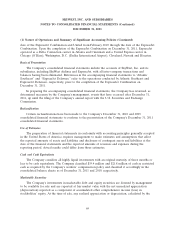

post-closing) based on a preliminary valuation performed by a third party valuation advisor (in

thousands):

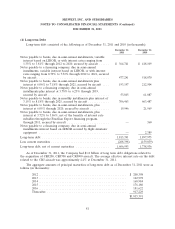

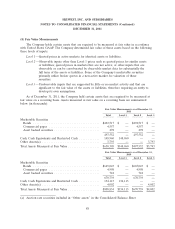

Current assets, net ........................................ $133,397

Property, plant and equipment ............................... 128,744

Other non-current assets .................................... 35,061

Current liabilities ......................................... (141,974)

Long-term liabilities ....................................... (3,173)

Purchase accounting gain ................................... (15,586)

Total consideration ...................................... $136,469

Less cash acquired ........................................ (82,452)

Net cash paid .......................................... $ 54,017

As part of the ExpressJet Merger, the Company recorded a purchase accounting gain of

$15.6 million during the year ended December 31 2010. This amount represents the difference between

the consideration paid and the net fair value of ExpressJet Holdings’ assets acquired and liabilities

assumed. The net fair value of the assets and liabilities acquired in the ExpressJet Merger was more

than the consideration paid. In connection with the preparation of the Company’s 2010 tax return, the

Company’s management identified an adjustment to the ExpressJet Merger that resulted in an increase

to the Company’s acquired deferred tax liabilities of $5.7 million during the year ended December 31,

2011. The adjustment is reflected on the consolidated statement of operations under the caption

‘‘Purchase accounting gain (adjustment).’’ The Company has determined that the adjustment to the

purchase accounting gain is not material to either the prior or current period financial statements

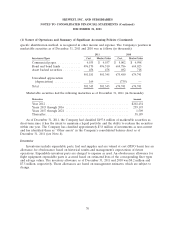

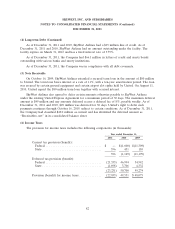

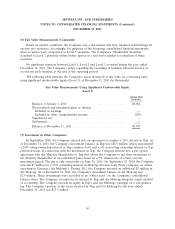

The following unaudited pro forma combined results of operations give effect to the ExpressJet

Merger as if it had occurred at the beginning of the periods presented. The unaudited pro forma

combined results of operations do not purport to represent the Company’s consolidated results of

operations had the ExpressJet Merger occurred on the dates assumed, nor are these results necessarily

indicative of the Company’s future consolidated results of operations. The Company expects to realize

benefits from integrating the operations of Atlantic Southeast and ExpressJet, as discussed above, and

to incur certain one-time cash costs. The unaudited pro forma combined results of operations do not

reflect these benefits or costs.

Years ended

December 31,

2010 2009

Revenue ..................................... $3,476,415 $3,301,872

Net Income ................................... $ 59,264 $ 87,125

Basic earnings per share .......................... $ 1.07 $ 1.56

Diluted earnings per share ........................ $ 1.05 $ 1.53

(3) Segment Reporting

Generally accepted accounting principles require disclosures related to components of a company

for which separate financial information is available to and regularly evaluated by the company’s chief

operating decision maker (‘‘CODM’’) when deciding how to allocate resources and in assessing

performance.

79