SkyWest Airlines 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2011

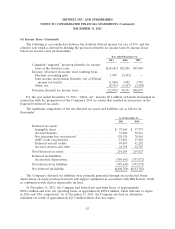

(6) Income Taxes (Continued)

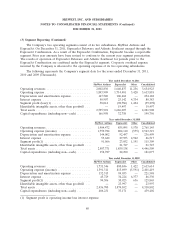

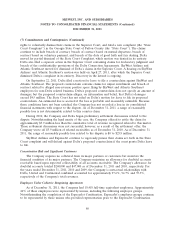

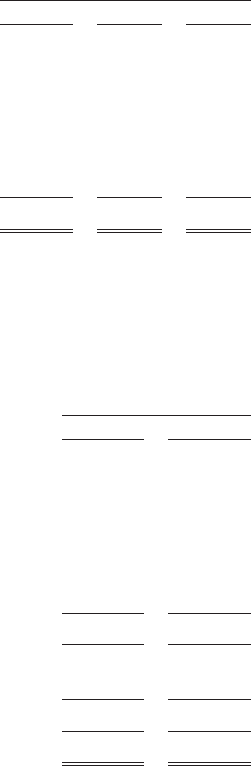

The following is a reconciliation between the statutory Federal income tax rate of 35% and the

effective rate which is derived by dividing the provision (benefit) for income taxes by income (loss)

before for income taxes (in thousands):

Year ended December 31,

2011 2010 2009

Computed ‘‘expected’’ provision (benefit) for income

taxes at the statutory rates ................... $(14,683) $52,888 $45,884

Increase (decrease) in income taxes resulting from:

Purchase accounting gain ................... 1,999 (5,455) —

State income tax provision (benefit), net of Federal

income tax benefit ....................... (1,810) 3,485 3,741

Other, net .............................. (8,341) (1,367) (1,550)

Provision (benefit) for income taxes ............. (22,835) 49,551 $48,075

For the year ended December 31, 2011, ‘‘Other, net’’ includes $7.2 million of benefit determined in

connection with the preparation of the Company’s 2010 tax return that resulted in an increase in the

ExpressJet deferred tax assets.

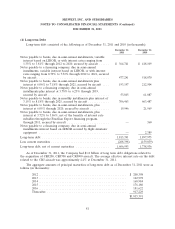

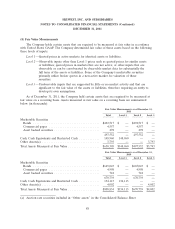

The significant components of the net deferred tax assets and liabilities are as follows (in

thousands):

As of December 31,

2011 2010

Deferred tax assets:

Intangible Asset ............................... $ 37,404 $ 37,779

Accrued benefits ............................... 35,460 30,316

Net operating loss carryforward .................... 128,134 70,861

AMT credit carryforward ......................... 15,882 15,882

Deferred aircraft credits ......................... 49,867 42,282

Accrued reserves and other ....................... 24,538 22,707

Total deferred tax assets ........................... 291,285 219,827

Deferred tax liabilities:

Accelerated depreciation ......................... (789,641) (733,572)

Total deferred tax liabilities ......................... (789,641) (733,572)

Net deferred tax liability ........................... $(498,356) $(513,745)

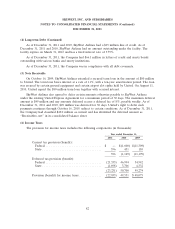

The Company’s deferred tax liabilities were primarily generated through an accelerated bonus

depreciation on newly purchased aircraft and support equipment in accordance with IRS Section 168(k)

in combination with shorter depreciable tax lives.

At December 31, 2011, the Company had federal net operating losses of approximately

$300.2 million and state net operating losses of approximately $858.6 million, which will start to expire

in 2026 and 2016, respectively. As of December 31, 2011, the Company also had an alternative

minimum tax credit of approximately $15.9 million which does not expire.

83