SkyWest Airlines 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

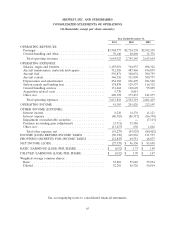

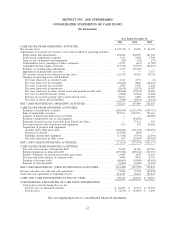

December 31, 2011, net sales of marketable securities increased $199.6 million, as compared to the year

ended December 31, 2010. Our aircraft and rotable spare parts purchased increased $17.5 million

during the year ended December 31, 2011, as compared to the year ended December 31, 2010.

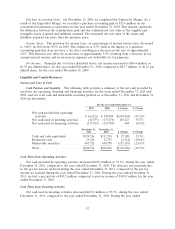

Cash Flows from Financing Activities.

Net cash used in financing activities decreased $0.4 million or 0.3%, during the year ended

December 31, 2011, compared to the year ended December 31, 2010.

Liquidity and Capital Resources

We believe that in the absence of unusual circumstances, the working capital currently available to

us and our cash flows from operations will be sufficient to meet our present financial requirements,

including anticipated expansion, planned capital expenditures, and scheduled lease payments and debt

service obligations for at least the next 12 months.

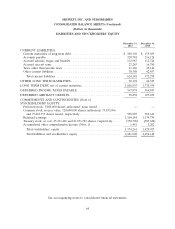

At December 31, 2011, our total capital mix was 45.4% equity and 54.6% long-term debt,

compared to 45.0% equity and 55.0% long-term debt at December 31, 2010.

As of December 31, 2011 and 2010, SkyWest Airlines had a $25 million line of credit. As of

December 31, 2011 and 2010, SkyWest Airlines had no amount outstanding under the facility. The

facility expires on March 31, 2012 and has a fixed interest rate of 3.79%.

As of December 31, 2011, we had $66.1 million in letters of credit and surety bonds outstanding

with various banks and surety institutions.

As of December 31, 2011 and 2010, we classified $19.4 million and $21.8 million as restricted cash,

respectively, related to our workers compensation policies.

Significant Commitments and Obligations

General

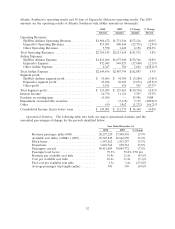

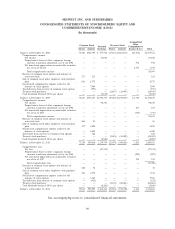

The following table summarizes our commitments and obligations as noted for each of the next

five years and thereafter (in thousands):

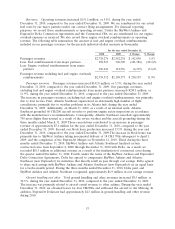

Total 2012 2013 2014 2015 2016 Thereafter

Operating lease payments for

aircraft and facility obligations $2,562,268 $392,165 $369,002 $348,323 $305,828 $239,698 $ 907,252

Interest commitments(A) ..... 511,788 77,611 70,714 64,374 57,701 50,695 190,693

Principal maturities on

long-term debt ........... 1,815,391 208,398 162,978 168,984 176,180 181,622 917,229

Total commitments and

obligations .............. $4,889,447 $678,174 $602,694 $581,681 $539,709 $472,015 $2,015,174

(A) At December 31, 2011, we had variable rate notes representing 33.0% of our total long-term debt.

Interest commitments will change based on the actual variable interest.

Purchase Commitments and Options

We have not historically funded a substantial portion of our aircraft acquisitions with working

capital. Rather, we have generally funded our aircraft acquisitions through a combination of operating

leases and long-term debt financing. At the time of each aircraft acquisition, we evaluate the financing

alternatives available to us, and select one or more of these methods to fund the acquisition. In the

event that alternative financing cannot be arranged at the time of delivery, Bombardier has typically

58