SkyWest Airlines 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the book value of our aircraft is impaired. Based on the results of the evaluations, our management

concluded no impairment was necessary as of December 31, 2011. However, there is inherent risk in

estimating the future cash flows used in the impairment test. If cash flows do not materialize as

estimated, there is a risk the impairment charges recognized to date may be inaccurate, or further

impairment charges may be necessary in the future.

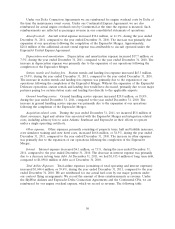

Stock-Based Compensation Expense

We estimate the fair value of stock options as of the grant date using the Black-Scholes option

pricing model. We use historical data to estimate option exercises and employee termination in the

option pricing model. The expected term of options granted is derived from the output of the option

pricing model and represents the period of time that options granted are expected to be outstanding.

The expected volatilities are based on the historical volatility of our common stock and other factors.

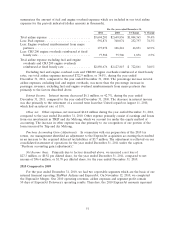

Fair value

We hold certain assets that are required to be measured at fair value in accordance with United

States GAAP. We determined fair value of these assets based on the following three levels of inputs:

Level 1— Quoted prices in active markets for identical assets or liabilities.

Level 2— Observable inputs other than Level 1 prices such as quoted prices for similar assets

or liabilities; quoted prices in markets that are not active; or other inputs that are

observable or can be corroborated by observable market data for substantially the

full term of the assets or liabilities. Some of our marketable securities primarily

utilize broker quotes in a non-active market for valuation of these securities.

Level 3— Unobservable inputs that are supported by little or no market activity and that are

significant to the fair value of the assets or liabilities, therefore requiring an entity to

develop its own assumptions.

We utilize several valuation techniques in order to assess the fair value of our financial assets and

liabilities. Our cash and cash equivalents primarily utilize quoted prices in active markets for identical

assets or liabilities.

We have valued non-auction rate marketable securities using quoted prices in active markets for

identical assets or liabilities. If a quoted price is not available, we utilize broker quotes in a non-active

market for valuation of these securities. For auction-rate security instruments, quoted prices in active

markets are no longer available. As a result, we have estimated the fair values of these securities

utilizing a discounted cash flow model.

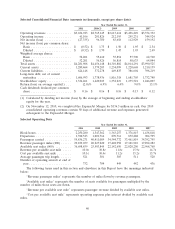

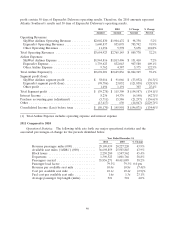

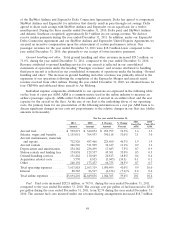

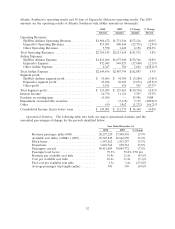

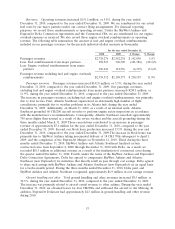

Results of Operations

Our Business Segments

For the year ended December 31, 2011, we had two reportable segments which are the basis of our

internal financial reporting: SkyWest Airlines and ExpressJet (which reflects the combined operations

of Atlantic Southeast and ExpressJet Delaware). On December 31, 2011, we completed the ExpressJet

Combination, which ended ExpressJet Delaware’s existence as a separate entity. On November 12,

2010, we completed the ExpressJet Merger. Our 2010 operating revenues, airline expenses and segment

45