SkyWest Airlines 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.financed our aircraft acquisitions until more permanent arrangements can be made. Subsequent to this

initial acquisition of an aircraft, we may also refinance the aircraft or convert one form of financing to

another (e.g., replacing debt financing with leveraged lease financing).

At present, we intend to fund our acquisition of any additional aircraft through a combination of

operating leases and debt financing, consistent with our historical practices. Based on current market

conditions and discussions with prospective leasing organizations and financial institutions, we currently

believe that we will be able to obtain financing for our committed acquisitions, as well as additional

aircraft, without materially reducing the amount of working capital available for our operating activities.

Nonetheless, recent disruptions in the credit markets have resulted in greater volatility, decreased

liquidity and limited availability of capital, and there is no assurance that we will be able to obtain

necessary funding or that, if we are able to obtain necessary capital, the corresponding terms will be

favorable or acceptable to us.

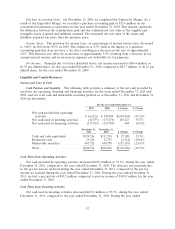

Aircraft Lease and Facility Obligations

We also have significant long-term lease obligations, primarily relating to our aircraft fleet. At

December 31, 2011, we had 556 aircraft under lease with remaining terms ranging from one to

17 years. Future minimum lease payments due under all long-term operating leases were approximately

$2.6 billion at December 31, 2011. Assuming a 5.2% discount rate, which is the average rate used to

approximate the implicit rates within the applicable aircraft leases, the present value of these lease

obligations would have been equal to approximately $2.0 billion at December 31, 2011.

Long-term Debt Obligations

As of December 31, 2011, we had $1.8 billion of long term debt obligations related to the

acquisition of CRJ200, CRJ700 and CRJ900 aircraft. The average effective interest rate on the debt

related to the CRJ aircraft was approximately 4.4% at December 31, 2011.

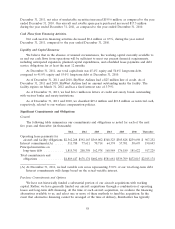

Guarantees

We have guaranteed the obligations of SkyWest Airlines under the SkyWest Airlines Delta

Connection Agreement and the obligations of ExpressJet under the ExpressJet Delta Connection

Agreement and SkyWest and ExpressJet have guaranteed the obligations of ExpressJet under the

Continental CPA.

New Accounting Standards

Fair Value Measurement and Disclosure Requirements

In May 2011, the Financial Accounting Standards Board (the ‘‘FASB’’) issued ‘‘Amendments to

Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs.’’

The standard revises guidance for fair value measurement and expands the disclosure requirements. It

is effective prospectively for fiscal years beginning after December 15, 2011. We do not anticipate that

our adoption of this standard will have a material impact on our consolidated financial statements.

Presentation of Comprehensive Income

In June 2011, the FASB issued ‘‘Presentation of Comprehensive Income.’’ The standard revises the

presentation and prominence of the items reported in other comprehensive income. It is effective

retrospectively for fiscal years beginning after December 15, 2011, with early adoption permitted. We

intend to adopt this standard for the quarter ending March 31, 2012. We do not anticipate that the

adoption of this standard will have a material impact on our consolidated financial statements.

59