SkyWest Airlines 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2011

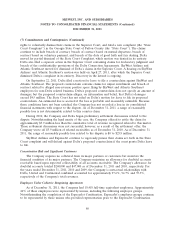

(8) Fair Value Measurements (Continued)

Based on market conditions, the Company uses a discounted cash flow valuation methodology for

auction rate securities. Accordingly, for purposes of the foregoing consolidated financial statements,

these securities were categorized as Level 3 securities. The Company’s ‘‘Marketable Securities’’

classified as Level 2 primarily utilize broker quotes in a non-active market for valuation of these

securities.

No significant transfers between Level 1, Level 2 and Level 3 occurred during the year ended

December 31, 2011. The Company’s policy regarding the recording of transfers between levels is to

record any such transfers at the end of the reporting period.

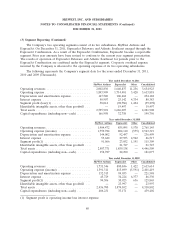

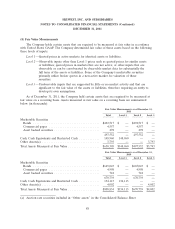

The following table presents the Company’s assets measured at fair value on a recurring basis

using significant unobservable inputs (Level 3) at December 31, 2011 (in thousands):

Fair Value Measurements Using Significant Unobservable Inputs

(Level 3)

Auction Rate

Securities

Balance at January 1, 2011 ................................. $4,002

Total realized and unrealized gains or (losses)

Included in earnings .................................... —

Included in other comprehensive income ..................... (209)

Transferred out .......................................... —

Settlements ............................................. —

Balance at December 31, 2011 ............................... $3,793

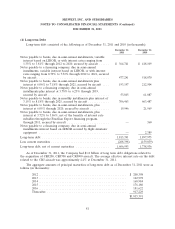

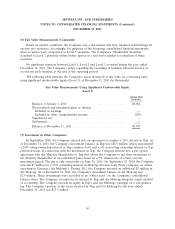

(9) Investment in Other Companies

In September 2008, the Company entered into an agreement to acquire a 20% interest in Trip. As

of December 31, 2011, the Company’s investment balance in Trip was $28.5 million, which represented

a 20% voting ownership interest in Trip common stock and a 6% non-voting ownership interest in Trip

preferred stock. In connection with the investment in Trip, the Company entered into a put option

agreement with the Majority Shareholder of Trip that allows the Company to put their investment to

the Majority Shareholder at an established price based on a 5% annual rate of return over the

investment period. The put is only exercisable on June 30, 2016. On September 29, 2010, the Company

invested $7 million for a 30% ownership interest in Mekong Aviation Joint Stock Company, an airline

operating in Vietnam (‘‘Air Mekong’’). During 2011, the Company invested an additional $3 million in

Air Mekong. As of December 31, 2011, the Company’s investment balance in Air Mekong was

$2.9 million. These investments were recorded as an ‘‘Other asset’’ on the Company’s consolidated

balance sheet. The Company accounts for its interest in Trip and Air Mekong using the equity method

of accounting. The Company records its equity in Trip’s and Air Mekong’s earnings on a one-quarter

lag. The Company’s portion of the losses incurred by Trip and Air Mekong for the year ended

December 31, 2011 was $13.3 million.

89