SkyWest Airlines 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

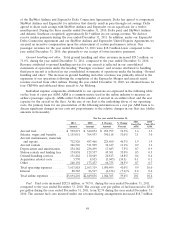

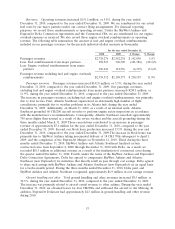

Ground handling service. Ground handling service expense increased $14.8 million, or 15.5%,

during the year ended December 31, 2010, compared to the year ended December 31, 2009. The

increase in ground handling expense was due primarily to 16 new pro-rate stations SkyWest Airlines

outsourced to other ground handlers since January 1, 2009.

Acquisition-related costs. During the year ended December 31, 2010, we incurred $8.8 million of

direct severance, legal and advisor fees associated with the ExpressJet Merger.

Other expenses. Other expenses, primarily consisting of property taxes, hull and liability insurance,

crew simulator training and crew hotel costs, increased $31.6 million, or 22.2%, during the year ended

December 31, 2010, compared to the year ended December 31, 2009. The increase in other expenses

was primarily due to the completion of the ExpressJet Merger on November 12, 2010.

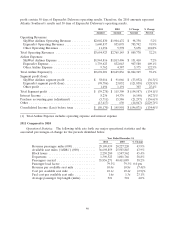

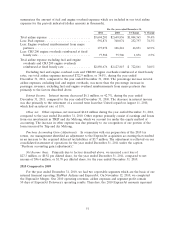

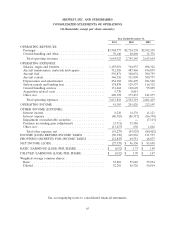

Total Airline Expenses. Total airline expenses (consisting of total operating and interest expenses)

increased $162.1 million, or 6.5%, during the year ended December 31, 2010, compared to the year

ended December 31, 2009. We are reimbursed for our actual fuel costs by our major partners under

our contract flying arrangements. We record the amount of those reimbursements as revenue. Under

the SkyWest Airlines and ExpressJet Delta Connection Agreements and the Continental CPA, we are

reimbursed for our engine overhaul expense, which we record as revenue. The following table

summarizes the amount of fuel and engine overhaul expenses which are included in our total airline

expenses for the periods indicated (dollar amounts in thousands).

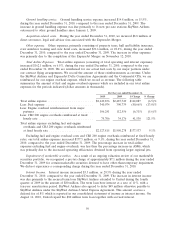

For the year ended December 31,

2010 2009 $ Change % Change

Total airline expense .......................... $2,649,836 $2,487,749 $162,087 (6.5)%

Less: Fuel expense ........................... 340,074 390,739 (50,665) (13.0)%

Less: Engine overhaul reimbursement from major

partners ................................. 106,241 112,556 (6,315) (5.6)%

Less: CRJ 200 engine overhauls reimbursed at fixed

hourly rate ............................... 75,706 34,176 41,530 121.5%

Total airline expense excluding fuel and engine

overhauls and CRJ 200 engine overhauls reimbursed

at fixed hourly rate ......................... $2,127,815 $1,950,278 $177,537 9.1%

Excluding fuel and engine overhaul costs and CRJ 200 engine overhauls reimbursed at fixed hourly

rates, our total airline expenses increased $177.5 million, or 9.1%, during the year ended December 31,

2010, compared to the year ended December 31, 2009. The percentage increase in total airline

expenses excluding fuel and engine overhauls, was less than the percentage increase in ASMs, which

was primarily due to the increased operating efficiencies obtained from operating larger regional jets.

Impairment of marketable securities. As a result of an ongoing valuation review of our marketable

securities portfolio, we recognized a pre-tax charge of approximately $7.1 million during the year ended

December 31, 2009 for certain marketable securities deemed to have other-than-temporary impairment.

We did not experience a corresponding charge during the year ended December 31, 2010.

Interest Income. Interest income increased $3.3 million, or 29.3% during the year ended

December 31, 2010, compared to the year ended December 31, 2009. The increase in interest income

was due primarily to the secured term loan SkyWest Airlines extended to United during the fourth

quarter of 2009 in the amount of $80 million. The term loan bore interest at a rate of 11%, with a

ten-year amortization period. SkyWest Airlines also agreed to defer $49 million otherwise payable to

SkyWest Airlines under the SkyWest Airlines United Express Agreement. This amount accrues a

deferral fee of 8% which is reported in our consolidated statement of income as interest income. On

August 11, 2010, United repaid the $80 million term loan together with accrued interest.

56