SkyWest Airlines 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Amount and allocation of grant—The total annual targeted long-term incentive grant value is 125%

of salary and targeted annual bonus for Mr. Atkin, 100% of salary and targeted annual bonus for

Messrs. Rich, Childs and Holt and 70% of salary and targeted annual bonus for Mr. Kraupp. The

Committee established these targeted amounts to provide a competitive pay package and to ensure that

a large portion of each Executive’s compensation is based on continuing long-term service and

correlated to the creation of shareholder value. This has been the Committee’s policy for several years,

but is subject to review and continuation or modification each year by the Committee. Mr. Atkin’s

targeted level of long-term incentive awards is higher than the targeted level of long-term incentive

awards for other Executives since he has overall responsibility for the long-term success of the

Company. Each Executive’s 2011 long-term incentive award was allocated among three types of long-

term awards, each with equal value, as follows: stock options, restricted stock units, and performance

units payable in cash.

The three types of awards were used in an effort to link the Executives’ long-term incentive

compensation with the creation of shareholder value. The value of stock options, restricted stock units

and shares of restricted stock is directly related to the value of the Common Stock. The Executives

earn performance units payable in cash by meeting return on shareholder equity objectives that the

Committee believes also lead to long-term shareholder value, but are not subject to short-term stock

market volatility.

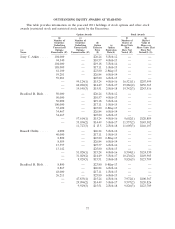

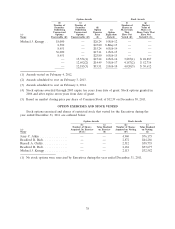

Stock options, restricted stock unit and performance unit grants in 2011 were made pursuant to

the Company’s 2010 Long-Term Incentive Plan, as shown in greater detail below in the table labeled

‘‘Grants of Plan Based Awards.’’

Stock Options—Options are granted with an exercise price equal to the closing price per share on

the date of grant and vest three years after the date of grant. Grants are made on a systematic

schedule, generally one grant per year made at the first Committee meeting of each year.

The purpose of the one-third weighting on stock options is to tie a significant percentage of the

award’s ultimate value to increases in the stock price, thereby rewarding increased value to the

shareholders. A stock option only has a value to the extent the value of the underlying shares on the

exercise date exceeds the exercise price. Accordingly, stock options provide compensation only if the

underlying share price increases over the option term and the Executive’s employment continues

through the vesting date.

The size of the grant for each Executive is calculated by determining the number of shares with a

theoretical future value equal to the targeted compensation for stock options, assuming each option will

have a value equal to 33% of its exercise price. This value generally correlates to the ASC Topic 718 value

of the awards.

The Company took additional measures to strengthen the performance- based nature of its long-

term incentive award program by subjecting two-thirds of each Executive’s stock option grant in 2011 to

a performance condition based on the return on shareholder equity attained in the year of grant (in

addition to the applicable tenure-based three-year vesting schedule). With respect to stock options, the

targeted level of shareholder return on equity for 2011 was 7.1%. All performance-based options

granted in 2011 to Executives would be forfeited if 2011 shareholder return on equity was less than

3.50%; forfeiture would have occurred on a pro-rated basis if shareholder return on equity fell between

3.5% and 7.1%. The actual shareholder return on equity for 2011 was zero and as a result, Mr. Atkin

forfeited all 39,089 options that were considered performance-based options awarded to him for 2011.

Mr. Rich forfeited all 23,454 options that were considered performance-based options awarded to him

for 2011 and each of Messrs. Childs and Holt forfeited all 19,857 options that were considered

performance-based options awarded to each of them for 2011. Mr. Kraupp was not granted

performance-based options in 2011 as he was appointed as the Chief Financial Officer of the Company

28