SkyWest Airlines 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To our Shareholders:

Thank you for your interest and investment in SkyWest. The challenging lessons learned in 2011, as a year of

transition, have helped us build a disciplined plan for 2012 and beyond to maintain SkyWest’s position of

leadership and strength in the industry. While we produced a net loss of $27.3 million in 2011, our current plan

provides for a return to profitability in 2012 and hopefully a trend of profitability similar to the 23 years prior to

2011. We believe our quality of service, cost competitiveness and financial strength gives us a competitive

advantage in capitalizing on new opportunities in an increasingly challenging industry.

Challenges in 2011

Although we realized our short-term integration goals in the acquisition of ExpressJet, we incurred additional

costs in obtaining single operating carrier status and in working through operational challenges while we

established proper manpower planning. The remaining integration benefits and cost reductions, previously

identified, are largely contingent upon finalizing collective bargaining agreements. While the ExpressJet acquisition

has not yet yielded the financial return we anticipated, we believe that it will as well as provide us future aircraft

replacement opportunities.

Some of the factors that contributed to higher operating costs for SkyWest and others in the industry were

maintenance cost increases due to aging aircraft and labor costs, both of which are rising at a higher rate than rate

escalations provided for in our contracts with our major partners. Reductions in utilization and stage-length were

also contributing factors that increased the unit costs for our operations without a corresponding increase in rate

reimbursements from our major partners to offset these higher costs.

During 2011, we were in the middle of a three year engine overhaul cycle for engines on our United CRJ200

regional jet fleet and we incurred total overhaul costs of $77.5 million. Planned spending levels for these overhauls

are estimated to be $50 million in 2012 and $20 million in 2013. Costs at ExpressJet are higher than competitive

standards and in addition to the integration savings are expected to be reduced in each of the following two years.

Going forward, we are addressing these issues through gaining better control over aging aircraft costs and

through rate discussions with our major partners that reflect the realities of operating these aircraft.

Accomplishments in 2011

Despite these challenges, 2011 was also a year of significant accomplishments. In November 2011, we

completed the process of obtaining a single operating certificate for Atlantic Southeast Airlines and ExpressJet, a

tremendous achievement that was completed in only 12 months, an unprecedented time for two carriers of this

size. We also completed the corporate merger between the two entities on December 31, 2011 and rebranded the

two airlines as ExpressJet Airlines. We are continuing to make strides in integrating ExpressJet. We are proud of

the progress we have made in creating ‘‘one team’’.

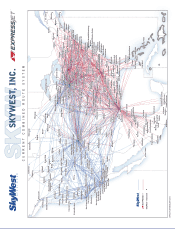

In 2011 we also expanded and diversified our partner relationships, launching new codeshare agreements with

US Airways and Alaska Airlines. The enhanced customer base of these new relationships, may provide

opportunities to expand in the future.

SkyWest not only created new partnerships in 2011, we also expanded relationships with our existing partners,

adding 28 new and used regional jet aircraft during 2011, highlighting our position as a partner of choice for our

major customers.

Finally, with the addition of ExpressJet to the SkyWest portfolio, we have grown gross revenues by over 30%

to $3.7 billion, and became the largest operator of Embraer 145 regional jet aircraft. We are also the largest

operator of Bombardier regional jet aircraft as well. Operating from both these vantage points, it gives us a strong

base of revenues to work from to drive future cost reductions and enhances our ability to deliver flexible solutions

to our major partners.

Financial Strength

SkyWest remains the premier credit in the industry with an unmatched balance sheet. SkyWest’s financial

strength, size and ability to use our balance sheet puts us in a position to help our major partners with sizeable

fleet changes and reduce disruption risk posed by our competitors. We have also been successful at structuring our

aircraft financing terms to coincide closely with the term of our long-term CPA agreements, thereby limiting our

exposure to ‘‘tail risk.’’ This financial strength puts us in a unique position to capitalize on opportunities as they

arise and facilitates our asset strategy of the future as noted below.

Scale Advantages

We believe that our scale gives us sustainable competitive advantages that are not available to our

competitors. Our broad service capabilities and network allows us to quickly respond to opportunities in any part

of the country with a wide range of aircraft assets. We also believe that our scale confers significant advantages in