SkyWest Airlines 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

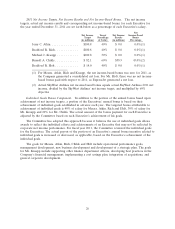

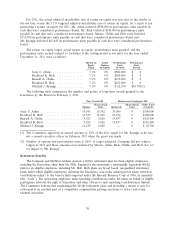

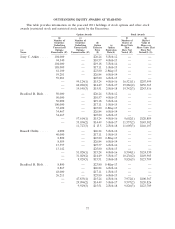

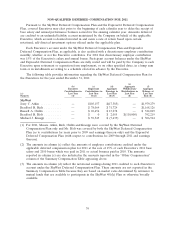

For 2011, the actual adjusted shareholder rate of return on equity was zero due to the results of

the net loss, versus the 7.1% targeted adjusted shareholder rate of return on equity. As a result of not

generating a return on equity for 2011, Mr. Atkin forfeited $300,000 in performance units payable in

cash that were considered performance-based, Mr. Rich forfeited $180,000 in performance units

payable in cash that were considered performance-based, Messrs. Childs and Holt each forfeited

$152,400 in performance units payable in cash that were considered performance-based and

Mr. Kraupp forfeited $43,645 in performance units payable in cash that were considered performance-

based.

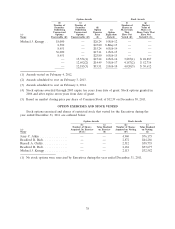

The return on equity target, actual return on equity, performance units granted, and the

performance units earned (subject to forfeiture if the vesting period is not met) for the year ended

December 31, 2011 were as follows:

Return on Actual Performance Performance

Equity Return Units Units

Target on Equity Granted Earned

Jerry C. Atkin .................. 7.1% 0% $300,000 $ 0

Bradford R. Rich ............... 7.1% 0% $180,000 $ 0

Russell A. Childs ................ 7.1% 0% $152,400 $ 0

Bradford R. Holt ................ 7.1% 0% $152,400 $ 0

Michael J. Kraupp ............... 7.1% 0% $ 62,350 $18,705(1)

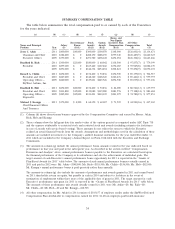

The following table summarizes the number and nature of long-term awards granted to the

Executives by the Board on February 2, 2011.

Time Vested LTI Performance-Contingent LTI

Shares/Stock Shares/Stock Other Units

Options Units Options(2) Units (Cash)(2)

Jerry C. Atkin ...................... 19,545 19,342 39,089 0 $300,000

Bradford R. Rich .................... 11,727 11,605 23,454 0 $180,000

Russell A. Childs .................... 9,929 9,826 19,857 0 $152,400

Bradford R. Holt .................... 9,929 9,826 19,857 0 $152,400

Michael J. Kraupp ................... 12,185 4,020 — 0 $ 62,350

(1) The Committee approved an earned amount of 30% of the 2011 target for Mr. Kraupp as he was

not a named executive officer in February 2011 when the grant was made.

(2) Number of options and performance units if 100% of target achieved. Company did not achieve

targets in 2011 and these amounts were forfeited by Messrs. Atkin, Rich, Childs, and Holt. See (1)

for impact to Mr. Kraupp

Retirement Benefits.

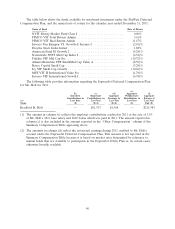

The Company and SkyWest Airlines sponsor a 401(k) retirement plan for their eligible employees,

including the Executives other than Mr. Holt. ExpressJet also maintains a substantially equivalent 401(k)

plan for its eligible employees, including Mr. Holt. Both plans are broad based, tax-qualified retirement

plans under which eligible employees, including the Executives, may make annual pre-tax salary reduction

contributions subject to the various limits imposed under the Internal Revenue Code of 1986, as amended

(the ‘‘Code’’). The sponsoring employers make matching contributions under the plans on behalf of eligible

participants; however the right of Executives and other officers to such matching contributions is limited.

The Committee believes that maintaining the 401(k) retirement plans and providing a means to save for

retirement is an essential part of a competitive compensation package necessary to attract and retain

talented executives.

30