SkyWest Airlines 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

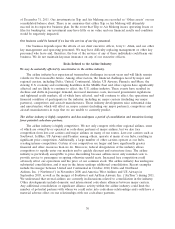

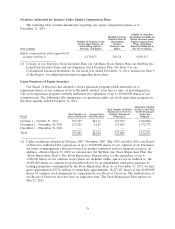

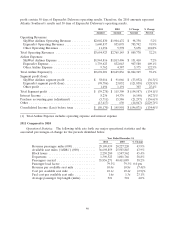

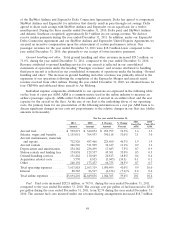

Securities Authorized for Issuance Under Equity Compensation Plans

The following table contains information regarding our equity compensation plans as of

December 31, 2011.

Number of Securities

Weighted-Average Remaining Available for

Exercise Price of Future Issuance under

Number of Securities to be Outstanding Equity Compensation

Issued upon Exercise of Options, Plans (Excluding

Outstanding Options, Warrants and Securities Reflected in

Plan Category Warrants and Rights Rights the First Column)

Equity compensation plans approved by

security holders(1) ............... 4,176,673 $19.26 6,030,117

(1) Consists of our Executive Stock Incentive Plan, our All Share Stock Option Plan, our SkyWest Inc.

Long Term Incentive Plan, and our Employee Stock Purchase Plan. See Note 9 to our

Consolidated Financial Statements for the fiscal year ended December 31, 2011, included in Item 8

of this Report, for additional information regarding these plans.

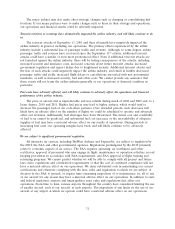

Issuer Purchases of Equity Securities

Our Board of Directors has adopted a stock repurchase program which authorizes us to

repurchase shares of our common stock in the public market, from time to time, at prevailing prices.

Our stock repurchase program currently authorizes the repurchase of up to 20,000,000 shares of our

common stock. The following table summarizes our purchases under our stock repurchase program for

the three months ended December 31, 2011.

Maximum Number

Total Number of Shares of Shares that May

Purchased as Part of a Yet Be Purchased

Total Number of Average Price Publicly Announced Under the

Period Shares Purchased Paid Per Share Program(1) Program

October 1 - October 31, 2011 .... 257,659 $12.11 257,659 1,690,000

November 1 - November 30, 2011 . 117,425 11.89 117,425 1,572,575

December 1 - December 31, 2011 . — — — —

Total ..................... 375,084 $12.04 375,084 1,572,575

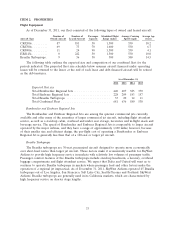

(1) Under resolutions adopted in February 2007, November 2007, May 2009 and May 2010, our Board

of Directors authorized the repurchase of up to 20,000,000 shares of our common stock. Purchases

are made at management’s discretion based on market conditions and our financial resources. In

addition, effective March 13, 2009, we entered into the SkyWest, Inc. Stock Repurchase Plan (the

‘‘Stock Repurchase Plan’’). The Stock Repurchase Plan provides for the repurchase of up to

3,400,000 shares of our common stock (which are included within, and are not in addition to, the

20,000,000 shares of common stock described above) by an independent third party pursuant to

trading parameters contemplated by the Stock Repurchase Plan. As of December 31, 2011, we had

spent approximately $337.6 million to repurchase approximately 18,427,425 shares of the 20,000,000

shares of common stock designated for repurchase by our Board of Directors. The authorization of

our Board of Directors does not have an expiration date. The Stock Repurchase Plan expires on

May 15, 2012.

38