SkyWest Airlines 2011 Annual Report Download - page 47

Download and view the complete annual report

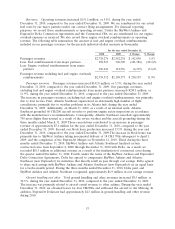

Please find page 47 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ended December 31, 2010, Delta paid, and SkyWest Airlines and Atlantic Southeast recognized,

approximately $6.9 million in cost savings revenue. We did not receive similar payments during the year

ended December 31, 2011.

During the year ended December 31, 2011, under our SkyWest Airlines and ExpressJet United

Express Agreements we incurred $77.6 million of CRJ200 engine maintenance expense, compared to

$75.7 million during the year ended December 31, 2010. We anticipate that the number of scheduled

engine maintenance events we experienced during each quarter of the year ended December 31, 2011

will likely continue through the middle of 2012, after which we expect a reduction in the number of

scheduled engine maintenance events.

Other expense, net, increased $14.0 million, during the year ended December 31, 2011, compared

to the year ended December 31, 2010. The increase was due, in large part, to our recognition of the

portion of the losses incurred by Trip and Air Mekong under the equity method of accounting.

Under our ExpressJet Delta Connection Agreement and our SkyWest Airlines and ExpressJet

United Express Agreements, we are paid incentive compensation upon the achievement of certain

performance criteria. Our passenger revenues for the year ended December 31, 2011 were $18.9 million

lower than our passenger revenues for the year ended December 31, 2010, due primarily to our receipt

of lower incentive payments from Delta and United under those agreements based on our performance

relative to the targets.

In connection with the preparation of our 2010 tax return, our management identified an

adjustment to the ExpressJet acquisition accounting that resulted in an increase to the acquired

deferred tax liabilities of $5.7 million. The adjustment is reflected on our consolidated statement of

operations for the year ended December 31, 2011 under the caption ‘‘Purchase accounting gain

(adjustment).’’

Critical Accounting Policies

Our significant accounting policies are summarized in Note 1 to our consolidated financial

statements for the year ended December 31, 2011, included in Item 8 of this Report. Critical

accounting policies are those policies that are most important to the preparation of our consolidated

financial statements and require management’s subjective and complex judgments due to the need to

make estimates about the effect of matters that are inherently uncertain. Our critical accounting

policies relate to revenue recognition, aircraft maintenance, aircraft leases, impairment of long-lived

assets and intangibles, stock-based compensation expense and fair value as discussed below. The

application of these accounting policies involves the exercise of judgment and the use of assumptions as

to future uncertainties and, as a result, actual results will differ, and could differ materially from such

estimates.

Revenue Recognition

Passenger and ground handling revenues are recognized when service is provided. Under our

contract and pro-rate flying agreements with our code-share partners, revenue is considered earned

when the flight is completed. Our agreements with our code-share partners contain certain provisions

pursuant to which the parties could terminate the respective agreement, subject to certain rights of the

other party, if certain performance criteria are not maintained. Our revenues could be impacted by a

number of factors, including changes to the code-share agreements, contract modifications resulting

from contract renegotiations and our ability to earn incentive payments contemplated under applicable

agreements. In the event contracted rates are not finalized at a quarterly or annual financial statement

date, we record that period’s revenues based on the lower of the prior period’s approved rates adjusted

for the current contract negotiations and our estimate of rates that will be implemented. Also, in the

event we have a reimbursement dispute with a major partner at a quarterly or annual financial

43