SkyWest Airlines 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2011

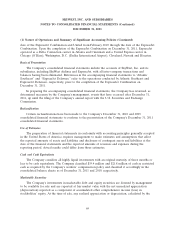

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

Income Taxes

The Company recognizes a liability or asset for the deferred tax consequences of all temporary

differences between the tax basis of assets and liabilities and their reported amounts in the consolidated

financial statements that will result in taxable or deductible amounts in future years when the reported

amounts of the assets and liabilities are recovered or settled.

Net Income (Loss) Per Common Share

Basic net income (loss) per common share (‘‘Basic EPS’’) excludes dilution and is computed by

dividing net income (loss) by the weighted average number of common shares outstanding during the

period. Diluted net income (loss) per common share (‘‘Diluted EPS’’) reflects the potential dilution

that could occur if stock options or other contracts to issue common stock were exercised or converted

into common stock. The computation of Diluted EPS does not assume exercise or conversion of

securities that would have an anti-dilutive effect on net income (loss) per common share. During the

years ended December 31, 2011, 2010 and 2009, 4,323,000, 4,183,000 and 4,356,000 shares reserved for

issuance upon the exercise of outstanding options were excluded from the computation of Diluted EPS

respectively, as their inclusion would be anti-dilutive.

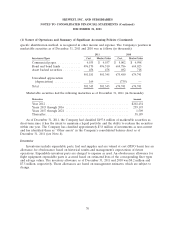

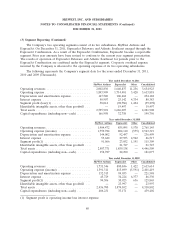

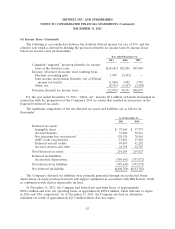

The calculation of the weighted average number of common shares outstanding for Basic EPS and

Diluted EPS are as follows for the years ended December 31, 2011, 2010 and 2009 (in thousands):

Year Ended December 31,

2011 2010 2009

Numerator:

Net Income (Loss) .......................... $(27,335) $96,350 $83,658

Denominator:

Denominator for basic earnings per-share weighted

average shares ........................... 52,201 55,610 55,854

Dilution due to stock options and restricted stock . . . — 916 960

Denominator for diluted earnings per-share weighted

average shares ........................... 52,201 56,526 56,814

Basic earnings (loss) per-share ................. $ (0.52) $ 1.73 $ 1.50

Diluted earnings (loss) per-share ................ $ (0.52) $ 1.70 $ 1.47

Comprehensive Income (Loss)

Comprehensive income (loss) includes charges and credits to stockholders’ equity that are not the

result of transactions with the Company’s shareholders. Also, comprehensive income (loss) consisted of

net income (loss) plus changes in unrealized appreciation (depreciation) on marketable securities and

unrealized gain (loss) on foreign currency translation adjustment related to the Company’s equity

76