SkyWest Airlines 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Agreements’’), pursuant to which ExpressJet is paid by Continental or United, as applicable, primarily

on a fee-per-completed block hour and departure basis, plus a margin based on performance incentives.

Competition and Economic Conditions

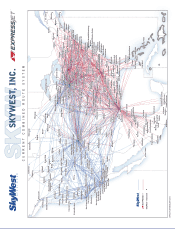

The airline industry is highly competitive. SkyWest Airlines and ExpressJet compete principally

with other code-sharing regional airlines, but also with regional airlines operating without code-share

agreements, as well as low-cost carriers and major airlines. The combined operations of SkyWest

Airlines and ExpressJet extend throughout most major geographic markets in the United States. Our

competition includes, therefore, nearly every other domestic regional airline, and to a certain extent,

most major and low-cost domestic carriers. The primary competitors of SkyWest Airlines and

ExpressJet among regional airlines with code-share arrangements include Air Wisconsin Airlines

Corporation (‘‘Air Wisconsin’’), American Eagle Airlines, Inc. (‘‘American Eagle’’) (owned by American

Airlines, Inc. (‘‘American’’)), Comair, Inc. (‘‘Comair’’) (owned by Delta), Compass Airlines

(‘‘Compass’’), , Horizon Air Industries, Inc. (‘‘Horizon’’) (owned by Alaska Air Group, Inc. (‘‘Alaska

Airlines’’)), Mesa Air Group, Inc. (‘‘Mesa’’), Pinnacle Airlines Corp. (‘‘Pinnacle’’), Republic Airways

Holdings Inc. (‘‘Republic’’) and Trans State Airlines, Inc.(‘‘Trans State’’). Major airlines award contract

flying to these regional airlines based upon, but not limited to, the following criteria: low cost, financial

resources, overall customer service levels relating to on-time arrival and departure statistics,

cancellation of flights, baggage handling performance and the overall image of the regional airline as a

whole. The principal competitive factors we experience with respect to our pro-rate flying include fare

pricing, customer service, routes served, flight schedules, aircraft types and relationships with major

partners.

The principal competitive factors for code-share partner regional airlines are code-share agreement

terms, customer service, aircraft types, fare pricing, flight schedules and markets and routes served. The

combined operations of SkyWest Airlines and ExpressJet represent the largest regional airline

operation in the United States. However, some of the major and low-cost carriers are larger, and have

greater financial and other resources than SkyWest Airlines and ExpressJet, individually or collectively.

Additionally, regional carriers owned by major airlines, such as American Eagle and Comair, may have

access to greater resources, through their parent companies, than SkyWest Airlines and ExpressJet, and

may have enhanced competitive advantages since they are subsidiaries of major airlines. Moreover,

federal deregulation of the industry allows competitors to rapidly enter our markets and to quickly

discount and restructure fares. The airline industry is particularly susceptible to price discounting

because airlines incur only nominal costs to provide service to passengers occupying otherwise unsold

seats.

Generally, the airline industry is highly sensitive to general economic conditions, in large part due

to the discretionary nature of a substantial percentage of both business and leisure travel. Many airlines

have historically reported lower earnings or substantial losses during periods of economic recession,

heavy fare discounting, high fuel costs and other disadvantageous environments. Economic downturns,

combined with competitive pressures, have contributed to a number of reorganizations, bankruptcies,

liquidations and business combinations among major and regional carriers. The effect of economic

downturns may be somewhat mitigated by the predominantly contract-based flying arrangements of

SkyWest Airlines and ExpressJet. Nevertheless, the per-passenger component in such fee structure

would be affected by an economic downturn. In addition, if Delta or United, or any of our other

code-share partners, experience a prolonged decline in passenger load or are harmed by low ticket

prices or high fuel prices, they will likely seek to renegotiate their code-share agreements with SkyWest

Airlines and ExpressJet, as applicable, or cancel flights in order to reduce their costs.

6