Royal Caribbean Cruise Lines 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

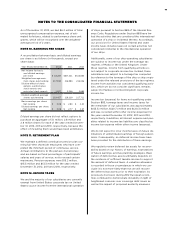

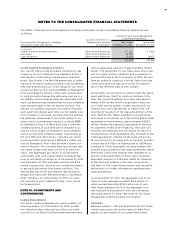

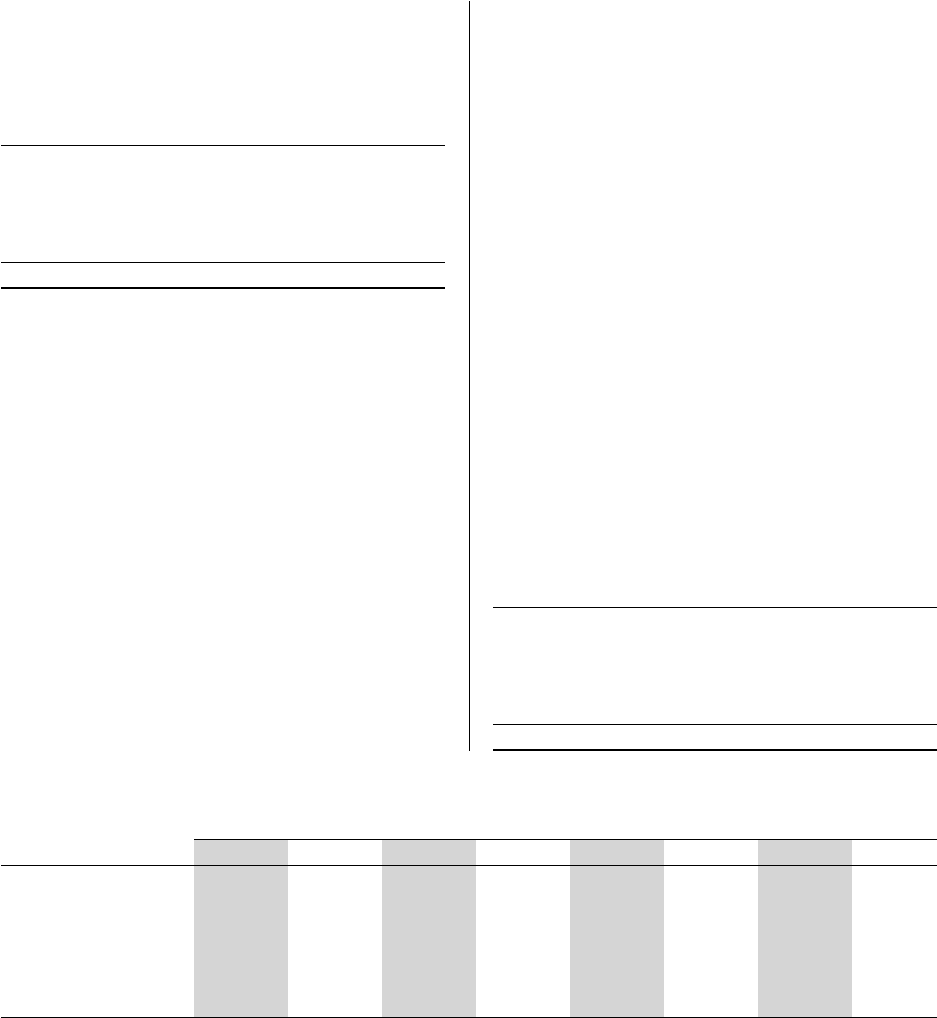

In addition, we are obligated under other noncancel-

able operating leases primarily for offices, ware-

houses and motor vehicles. As of December 31, 2012,

future minimum lease payments under noncancelable

operating leases were as follows (in thousands):

Year

Thereafter

Total expense for all operating leases amounted to

$61.6 million, $60.2 million and $50.8 million for the

years 2012, 2011 and 2010, respectively.

Other

Some of the contracts that we enter into include

indemnification provisions that obligate us to make

payments to the counterparty if certain events occur.

These contingencies generally relate to changes in

taxes, increased lender capital costs and other similar

costs. The indemnification clauses are often standard

contractual terms and are entered into in the normal

course of business. There are no stated or notional

amounts included in the indemnification clauses and

we are not able to estimate the maximum potential

amount of future payments, if any, under these

indemnification clauses. We have not been required

to make any payments under such indemnification

clauses in the past and, under current circumstances,

we do not believe an indemnification in any material

amount is probable.

If (i) any person other than A. Wilhelmsen AS. and

Cruise Associates and their respective affiliates (the

“Applicable Group”) acquires ownership of more than

33% of our common stock and the Applicable Group

owns less of our common stock than such person, or

(ii) subject to certain exceptions, during any 24-month

period, a majority of the Board is no longer comprised

of individuals who were members of the Board on the

first day of such period, we may be obligated to pre-

pay indebtedness outstanding under the majority of

our credit facilities, which we may be unable to replace

on similar terms. Certain of our outstanding debt

securities also contain change of control provisions

that would be triggered by the acquisition of greater

than 50% of our common stock by a person other

than a member of the Applicable Group coupled with

a ratings downgrade. If this were to occur, it would

have an adverse impact on our liquidity and operations.

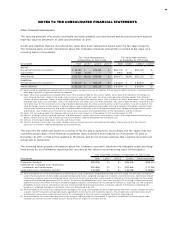

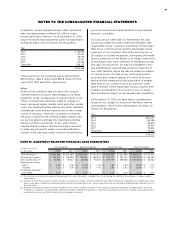

At December 31, 2012, we have future commitments

to pay for our usage of certain port facilities, marine

consumables, services and maintenance contracts as

follows (in thousands):

Year

Thereafter

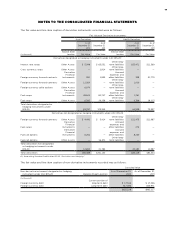

NOTE 15. QUARTERLY SELECTED FINANCIAL DATA (UNAUDITED)

(in thousands, except First Quarter Second Quarter Third Quarter Fourth Quarter

per share data)

Total revenues(1)

Operating income(2) ()

Net income (loss)(2,3) () ()

Earnings per share:

Basic () ()

Diluted () ()

Dividends declared

per share — —

() Our revenues are seasonal based on the demand for cruises. Demand is strongest for cruises during the Northern Hemisphere’s summer months

and holidays.

() Amounts for the fourth quarter of 2012 include an impairment charge of $385.4 million to write down Pullmantur’s goodwill to its implied fair value

and to write down trademarks and trade names and certain long-lived assets, consisting of three aircraft owned and operated by Pullmantur Air, to

their fair value.

() Amounts for the fourth quarter of 2012 include a $33.7 million charge to record a 100% valuation allowance related to our deferred tax assets for

Pullmantur. In addition, we reduced the deferred tax liability related to Pullmantur’s trademarks and trade names by $5.2 million. These adjustments

resulted in an increase of $28.5 million to other (expense) income.