Royal Caribbean Cruise Lines 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

PART II

to continue these efforts during 2013. In addition, dur-

ing 2013 we will continue to strengthen our revenue

enhancement opportunities by strategically investing

in a number of projects, including the introduction

of beverage packages fleet wide, retail and casino

enhancements, the continuation of our vessel revital-

ization program, the introduction of new onboard rev-

enue initiatives and various information technology

infrastructure investments. We also intend to enhance

our focus on identifying the needs of our guests and

creating product features that our customers value.

We are focused on targeting high-value guests by

better understanding consumer data and insights and

creating communication strategies that best resonate

with our target audiences. In 2013, we will continue to

focus on the development of key markets in Asia and

we will focus on sourcing guests and adding capacity

to other markets where we expect significant growth

and profitability, such as Australia. We believe these

initiatives will provide opportunities for increased

ticket and onboard revenues with the ultimate goal of

maximizing our long-term return on invested capital

and shareholder value.

During 2012, we took delivery of Celebrity Reflection,

the fifth and final Solstice-class ship, and ordered a

third Oasis-class ship through a conditional agreement.

The agreement is subject to certain closing conditions

and is expected to become effective in the first quar-

ter of 2013. The ship is scheduled for delivery in the

second quarter of 2016. We also have two Quantum-

class ships on order for Royal Caribbean International

which are expected to enter service in the third quarter

of 2014 and in the second quarter of 2015, respectively,

and two ships on order for our joint venture TUI Cruises

which are scheduled for delivery in the second quar-

ter of 2014 and second quarter of 2015, respectively.

As part of our vessel revitalization program, five ships

were revitalized for the Royal Caribbean International

brand during 2012. By the end of 2013, we expect that

all of the Vision-class and Freedom-class ships and

all but one of the Radiance-class ships will have been

revitalized. For the Celebrity Cruises brand, two ships

underwent revitalization during 2012 to incorporate

certain Solstice-class features. By the end of 2013, the

Millennium-class revitalization program will be com-

plete as the final ship is scheduled to be revitalized

during the course of 2013.

As of December 31, 2012, our liquidity position remained

strong at $2.2 billion, consisting of approximately

$194.9 million in cash and cash equivalents and $2.0

billion available under our unsecured credit facilities.

In addition, we continue to be focused on our goal

of returning to an investment grade credit rating. We

have already made strides in this direction and further

improvements are anticipated through increasing

operating cash flow, a moderate capital expenditure

program, retiring of debt and favorable financing

programs.

In 2012, we implemented a number of actions in fur-

therance of our refinancing strategy for our maturities

in 2013 and 2014. These actions, which enabled us to

refinance a portion of our outstanding indebtedness

with later maturity debt without increasing our total

level of indebtedness included:

• obtaining funds through the incurrence of $940.0

million of new debt obligations, including $650.0

million of 5.25% unsecured senior notes due

November 2022 and a $290.0 million unsecured

term loan due February 2016. With these funds

we were able to repay amounts outstanding under

our revolving credit facilities and repurchase €255.0

million, or approximately $328.0 million, in aggre-

gate principal amount of our €1.0 billion 5.625%

unsecured senior notes due 2014, and

• our establishment of new borrowing capacity,

including €365.0 million in available capacity under

a Euro-denominated unsecured term loan due July

2017 to be drawn at any time on or prior to June 30,

2013 and $233.0 million of additional revolving

credit capacity utilizing the accordion feature on our

revolving facility due July 2016.

During 2013, it is likely we will secure additional liquid-

ity in the capital and/or credit markets as part of our

refinancing strategy for our upcoming 2013 and 2014

maturities. We anticipate funding these maturities

and other obligations in 2013 through a combination

of currently available and anticipated new credit facili-

ties and other financing arrangements and operating

cash flows.

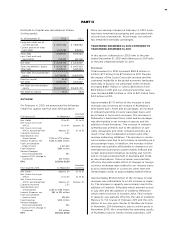

RESULTS OF OPERATIONS

In addition to the items discussed above under

“Executive Overview”, significant items for 2012

include:

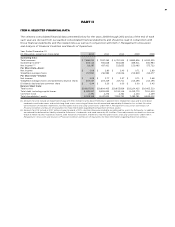

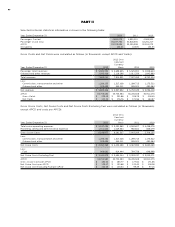

• Total revenues increased 2.0% to $7.7 billion from

$7.5 billion in 2011 partially due to a 1.5% increase in

Net Yields and a 1.4% increase in capacity (measured

by APCD for such period).

• Cruise operating expenses increased 4.3% to $5.2

billion from $4.9 billion in 2011 partially due to an

increase in fuel expenses and the 1.4% increase in

capacity noted above.

• We recognized an impairment charge of $385.4 mil-

lion to write down Pullmantur’s goodwill to its implied

fair value and to write down trademarks and trade