Royal Caribbean Cruise Lines 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

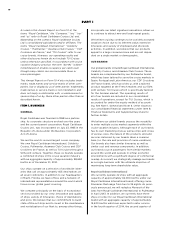

Our brands, including our 50% joint venture TUI

Cruises, have five ships on order. Two ships on order

are being built in Germany by Meyer Werft GmbH,

two are being built in Finland by STX Finland and one

will be built in France by STX France. The expected

dates that our ships on order will enter service and

their approximate berths are as follows:

Ship

Expectedto

EnterService

Approximate

Berths

Royal Caribbean

International—

Quantum-class:

Quantum of the Seas thQuarter

Anthem of the Seas ndQuarter

Oasis-class(1):

Unnamed ndQuarter

TUI Cruises—

Mein Schiff 3 ndQuarter

Mein Schiff 4 ndQuarter

TotalBerths

() InDecemberweorderedathirdOasis-classshipthrougha

conditionalagreementTheagreementissubjecttocertainclosing

conditionsandisexpectedtobecomeeffectiveinthefirstquarter

of

Seasonality

Our revenues are seasonal based on the demand for

cruises. Demand is strongest for cruises during the

Northern Hemisphere’s summer months and holidays.

In order to mitigate the impact of the winter weather

in the Northern Hemisphere and to capitalize on the

summer season in the Southern Hemisphere, our

brands have increased deployment to South America

and Australia during the Northern Hemisphere

winter months.

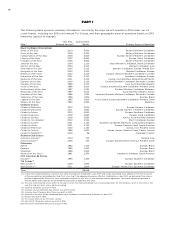

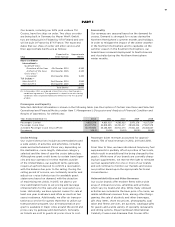

Passengers and Capacity

Selected statistical information is shown in the following table (see Description of Certain Line Items and Selected

Operational and Financial Metrics under Item 7. Management’s Discussion and Analysis of Financial Condition and

Results of Operations, for definitions):

Year Ended December 31,

Passengers Carried

Passenger Cruise Days

Available Passenger Cruise Days (APCD)

Occupancy

Cruise Pricing

Our cruise ticket prices include accommodations and

a wide variety of activities and amenities, including

meals and entertainment. Prices vary depending on

the destination, cruise length, stateroom category

selected and the time of year the cruise takes place.

Although we grant credit terms to certain travel agen-

cies and tour operators in select markets outside

of the United States, our payment terms generally

require an upfront deposit to confirm a reservation,

with the balance due prior to the sailing. During the

selling period of a cruise, we continually monitor and

adjust our cruise ticket prices for available guest

staterooms based on demand, with the objective

of maximizing net yields. In 2013, we plan to use

new optimization tools to set pricing and leverage

enhancements for the web and our reservation sys-

tems. Historically, we have opened cruises for sale at

least one year in advance and often as much as two

years in advance. Additionally, we offer air transpor-

tation as a service for guests that elect to utilize our

transportation program. Our air transportation pro-

gram is available in major cities around the world and

prices vary by gateway and destination. Generally,

air tickets are sold to guests at prices close to cost.

Passenger ticket revenues accounted for approxi-

mately 73% of total revenues in 2012, 2011 and 2010.

From time to time, we have introduced temporary fuel

supplements to partially offset a portion of fuel costs,

which result in an additional fee being charged to the

guests. While none of our brands are currently charg-

ing fuel supplements, we reserve the right to reinstate

our fuel supplements for one or more of our brands

and will continue to monitor our markets and review

our position based upon the appropriate facts and

circumstances.

Onboard Activities and Other Revenues

Our cruise brands offer modern fleets with a wide

array of onboard services, amenities and activities

which vary by brand and ship. While many onboard

activities are included in the base price of a cruise, we

realize additional revenues from, among other things,

gaming, the sale of alcoholic and other beverages,

gift shop items, shore excursions, photography, spa/

salon and fitness services, art auctions, catalogue gifts

for guests and a wide variety of specialty restaurants

and dining options. Royal Caribbean International,

Celebrity Cruises and Azamara Club Cruises offer

PART I