Royal Caribbean Cruise Lines 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

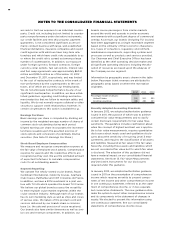

perform worse than contemplated in our discounted

cash flow model, or if there are material changes to

the projected future cash flows used in the impair-

ment analyses, especially in Net Yields, an additional

impairment charge of Pullmantur’s trademarks and

trade names may be required.

Finite-life intangible assets and related accumulated

amortization are immaterial to our 2012, 2011, and

2010 consolidated financial statements.

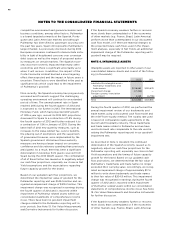

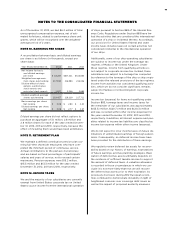

NOTE 5. PROPERTY AND EQUIPMENT

Property and equipment consists of the following

(in thousands):

Ships

Ship improvements

Ships under construction

Land, buildings and improve-

ments, including leasehold

improvements and port

facilities

Computer hardware and soft-

ware, transportation equip-

ment and other

Total property and equipment

Less—accumulated deprecia-

tion and amortization () ()

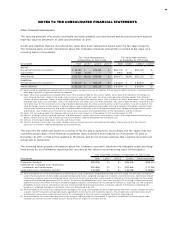

Ships under construction include progress payments

for the construction of new ships as well as planning,

design, interest, commitment fees and other associ-

ated costs. We capitalized interest costs of $13.3

million, $14.0 million and $28.1 million for the years

2012, 2011 and 2010, respectively.

During 2012, Pullmantur delivered Ocean Dream to

an unrelated third party as part of a six year bareboat

charter agreement. The charter agreement provides

a renewal option exercisable by the unrelated third

party for an additional four years. The charter agree-

ment constitutes an operating lease and charter reve-

nue is being recognized on a straight-line basis over

the six year charter term. The charter revenue rec-

ognized during 2012 was not material to our results

of operations.

We review our long-lived assets for impairment when-

ever events or changes in circumstances indicate,

based on estimated undiscounted future cash flows.

As part of step two of our goodwill impairment analy-

sis, (see Note 3. Goodwill for further information),

we identified that the estimated fair values of certain

long-lived assets, consisting of three aircraft owned

and operated by Pullmantur Air, were less than their

carrying values. As a result, we proceeded to our

long-lived asset impairment test. Pullmantur’s strategy

to further diversify its passenger sourcing and reduce

its reliance on the Spanish market has led us to reduce

the number of years during which we expect to use

these aircraft when performing the undiscounted cash

flow test. The undiscounted cash flows for Pullmantur’s

aircraft were determined to be less than their carrying

value and an impairment charge of $48.9 million was

required. This impairment charge was recognized

in earnings during the fourth quarter of 2012 and

is reported within Impairment of Pullmantur related

assets within our consolidated statements of com-

prehensive income (loss). See Note 13. Fair Value

Measurements and Derivative Instruments for further

discussion.

In December 2012, we reached a conditional agree-

ment with STX France to build the third Oasis-class

ship for Royal Caribbean International. The agree-

ment is subject to certain closing conditions and is

expected to become effective in the first quarter of

2013. The ship will have a capacity of approximately

5,400 berths and is expected to enter service in the

second quarter of 2016. If the agreement becomes

effective, Pullmantur’s Atlantic Star, which has been

out of operation since 2009, will be transferred to an

affiliate of STX France as part of the consideration.

The transfer is not expected to result in a gain or a

loss. In addition, we have an option to construct a

fourth Oasis-class ship which will expire five days

prior to the first anniversary of the effective date

of the contract.

NOTE 6. OTHER ASSETS

Variable Interest Entities

A Variable Interest Entity (“VIE”), is an entity in which

the equity investors have not provided enough equity

to finance the entity’s activities or the equity investors

(1) cannot directly or indirectly make decisions about

the entity’s activities through their voting rights or

similar rights; (2) do not have the obligation to absorb

the expected losses of the entity; (3) do not have the

right to receive the expected residual returns of the

entity; or (4) have voting rights that are not propor-

tionate to their economic interests and the entity’s

activities involve or are conducted on behalf of an

investor with a disproportionately small voting

interest.

We have determined that Grand Bahama Shipyard

Ltd. (“Grand Bahama”), a ship repair and maintenance

facility in which we have a 40% noncontrolling inter-

est, is a VIE. The facility serves cruise and cargo ships,

oil and gas tankers, and offshore units. We utilize this

facility, among other ship repair facilities, for our reg-

ularly scheduled drydocks and certain emergency