Royal Caribbean Cruise Lines 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

PART II

this measure. Accordingly, we do not believe that

reconciling information for such projected figures

would be meaningful.

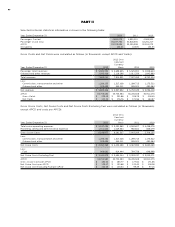

Occupancy, in accordance with cruise vacation indus-

try practice, is calculated by dividing Passenger

Cruise Days by APCD. A percentage in excess of 100%

indicates that three or more passengers occupied

some cabins.

Passenger Cruise Days represent the number of

passengers carried for the period multiplied by the

number of days of their respective cruises.

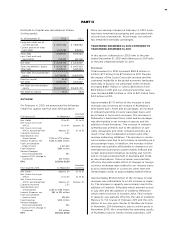

We believe that the impairment charges recognized

in 2012 related to Pullmantur’s goodwill, trademarks,

trade names and long-lived assets and the charges

related to the adjustments to Pullmantur’s deferred

tax assets and deferred tax liability (“the impairment

related charges”) are not an indication of our future

earnings performance. As such, we believe it is more

meaningful for the impairment related charges to be

excluded from our net income and earnings per share,

and accordingly, we have elected to also present

non-GAAP net income and non-GAAP EPS excluding

these impairment related charges for the year ended

December 31, 2012.

We believe Net Yields, Net Cruise Costs and Net

Cruise Costs Excluding Fuel are our most relevant

non-GAAP financial measures. However, a significant

portion of our revenue and expenses are denominated

in currencies other than the United States dollar.

Because our reporting currency is the United States

dollar, the value of these revenues and expenses can

be affected by changes in currency exchange rates.

Although such changes in local currency prices is just

one of many elements impacting our revenues and

expenses, it can be an important element. For this

reason, we also monitor Net Yields, Net Cruise Costs

and Net Cruise Costs Excluding Fuel as if the current

periods’ currency exchange rates had remained con-

stant with the comparable prior periods’ rates, or on

a “Constant Currency” basis.

It should be emphasized that Constant Currency is

primarily used for comparing short-term changes

and/or projections. Over the longer term, changes in

guest sourcing and shifting the amount of purchases

between currencies can significantly change the

impact of the purely currency-based fluctuations.

The use of certain significant non-GAAP measures,

such as Net Yields, Net Cruise Costs and Net Cruise

Costs Excluding Fuel, allow us to perform capacity

and rate analysis to separate the impact of known

capacity changes from other less predictable changes

which affect our business. We believe these non-GAAP

measures provide expanded insight to measure reve-

nue and cost performance in addition to the standard

United States GAAP based financial measures. There

are no specific rules or regulations for determining

non-GAAP and Constant Currency measures, and as

such, there exists the possibility that they may not be

comparable to other companies within the industry.

EXECUTIVE OVERVIEW

We believe our results of operations for 2012 demon-

strate the strength and resiliency of our brands and

the value proposition of a cruise vacation. Despite the

slow pace of the economic recovery and the continued

instability in the global economic landscape, especially

in Europe, our net income for 2012, before the impair-

ment related charges, was $432.2 million and our Net

Yields increased 1.5%. During the fourth quarter of

2012, we recognized an impairment charge of $385.4

million to write down Pullmantur’s goodwill to its

implied fair value and to write down trademarks and

trade names and certain long-lived assets, consisting

of three aircraft owned and operated by Pullmantur

Air, to their fair value. In addition, we recognized a

$33.7 million charge to record a 100% valuation allow-

ance related to our deferred tax assets for Pullmantur

and we reduced the deferred tax liability related to

Pullmantur’s trademarks and trade names by $5.2 mil-

lion. As a result, our net income for 2012 was $18.3

million as compared to $607.4 million for 2011, which

was not impacted by the impairment related charges.

Our results of operations for the year ended December

31, 2012 were also negatively impacted by the effect

of the Costa Concordia incident on booking patterns

throughout the industry. These effects were magni-

fied by the timing of the incident, which occurred in

early 2012 during WAVE season (traditionally the first

two months of the year where cruise lines experience

disproportionately higher volume cruise sales). We

continue to believe the impact of the Costa Concordia

incident will not have a significant long term impact

on our business.

Our results of operations were also influenced by

changes to our international distribution system

mainly in Brazil implemented in late 2011 pursuant

to which we began directly distributing certain of

our cruises rather than indirectly distributing them

through charter arrangements. In addition, our results

were impacted by certain deployment initiatives

including, but not limited to, increased deployment

in Australia and China.

Our continued focus on cost control has helped us to

maintain our profitability despite a tough operating

environment with upward pressure on costs. We intend