Royal Caribbean Cruise Lines 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

As of December 31, 2012, we had $6.2 million of total

unrecognized compensation expense, net of esti-

mated forfeitures, related to performance share unit

grants, which will be recognized over the weighted-

average period of 2 years.

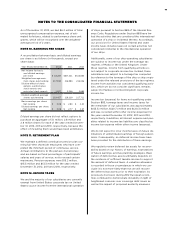

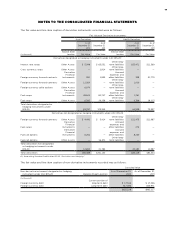

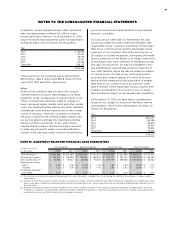

NOTE 10. EARNINGS PER SHARE

A reconciliation between basic and diluted earnings

per share is as follows (in thousands, except per

share data):

Year Ended December 31,

Net income for basic

and diluted earnings

per share

Weighted-average com-

mon shares outstanding

Dilutive effect of stock

options, performance

stock awards and

restricted stock awards

Diluted weighted-average

shares outstanding

Basic earnings per share:

Net income

Diluted earnings per share:

Net income

Diluted earnings per share did not reflect options to

purchase an aggregate of 3.1 million, 2.8 million and

2.6 million shares for each of the years ended Decem-

ber 31, 2012, 2011 and 2010, respectively, because the

effect of including them would have been antidilutive.

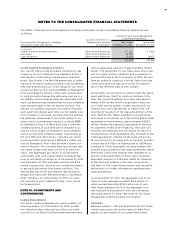

NOTE 11. RETIREMENT PLAN

We maintain a defined contribution pension plan cov-

ering full-time shoreside employees who have com-

pleted the minimum period of continuous service.

Annual contributions to the plan are discretionary

and are based on fixed percentages of participants’

salaries and years of service, not to exceed certain

maximums. Pension expenses were $15.2 million,

$15.3 million and $13.3 million for the years ended

December 31, 2012, 2011 and 2010, respectively.

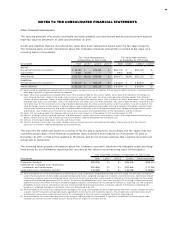

NOTE 12. INCOME TAXES

We and the majority of our subsidiaries are currently

exempt from United States corporate tax on United

States source income from the international operation

of ships pursuant to Section 883 of the Internal Rev-

enue Code. Regulations under Section 883 have lim-

ited the activities that are considered the international

operation of a ship or incidental thereto. Accordingly,

our provision for United States federal and state

income taxes includes taxes on certain activities not

considered incidental to the international operation

of our ships.

Additionally, some of our ship-operating subsidiaries

are subject to income tax under the tonnage tax

regimes of Malta or the United Kingdom. Under

these regimes, income from qualifying activities is

not subject to corporate income tax. Instead, these

subsidiaries are subject to a tonnage tax computed

by reference to the tonnage of the ship or ships regis-

tered under the relevant provisions of the tax regimes.

Income from activities not considered qualifying activ-

ities, which we do not consider significant, remains

subject to Maltese or United Kingdom corporate

income tax.

Income tax (expense) for items not qualifying under

Section 883, tonnage taxes and income taxes for

the remainder of our subsidiaries was approximately

$(55.5) million, $(20.7) million and $(20.3) million

and was recorded within other income (expense) for

the years ended December 31, 2012, 2011 and 2010,

respectively. In addition, all interest expense and pen-

alties related to income tax liabilities are classified as

income tax expense within other income (expense).

We do not expect to incur income taxes on future dis-

tributions of undistributed earnings of foreign subsid-

iaries. Consequently, no deferred income taxes have

been provided for the distribution of these earnings.

We regularly review deferred tax assets for recover-

ability based on our history of earnings, expectations

of future earnings, and tax planning strategies. Real-

ization of deferred tax assets ultimately depends on

the existence of sufficient taxable income to support

the amount of deferred taxes. A valuation allowance

is recorded in those circumstances in which we con-

clude it is not more-likely-than-not we will recover

the deferred tax assets prior to their expiration. As

previously disclosed, during 2012 European econo-

mies continued to demonstrate instability in light of

heightened concerns over sovereign debt issues as

well as the impact of proposed austerity measures