Royal Caribbean Cruise Lines 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD.

One particularly difficult challenge last year

was the economic situation in Spain, which

became so dire in fact, that we felt it appro-

priate to record non-cash impairment charges

againstourintangibleassetsthere.Adjusting

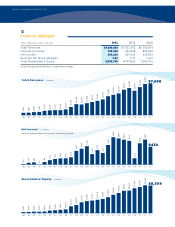

for these charges, net income for the year was

$432.2 million or $1.97 per diluted share. We

continue to deliver strong cash flows, and cash

provided by operating activities was $1.4 billion

in 2012.

We have always considered the safety of

our guests and crew as a “sine qua non” as

our vessels ply the seven seas. We are keenly

aware of the level of focus our industry has

been receiving regarding safety and security.

It is with a bit of irony that this scrutiny actually

allowsustoarticulatebetterjusthowinvested

weare,andwhatagoodjobisbeingdone

regarding the safety and security of our guests

and crew. Most recently, Royal Caribbean and the

cruise industry, through the coordinated efforts

of the industry trade group CLIA, embarked

on a voluntary operational safety review. This

review was designed to improve transparency

as well as identify best practices and improve-

ment opportunities across the cruising industry.

A summary of this initiative is available on

CLIA’s website at: www.cruising.org.

While there is no such thing as perfect

safety, there can be a perfect dedication to

safety and we work hard to achieve that.

FOR THE FUTURE: A MEASURED APPROACH

WITH A LONG-TERM PAYOFF

For 2013, we are seeing a recovery pattern in

pricing, in earnings and in our debt leverage

statistics. Capital commitments are at the lowest

level in a long time as we focus on revitalizing

our existing fleet and slow new vessel deliveries.

This should generate meaningful cash flow for

debt repayment and returns to shareholders

going forward.

The last few years have presented us with

an extraordinary level of challenges both large

and small which have seriously hurt our profit-

ability. The scale and diversity of these events,

rangingfrommajorfinancialmeltdowns,to

vessel incidents, to political crises, has been

unprecedented. While this has been extremely

frustrating, it also has a silver lining—demon-

stratingjusthowresilientourbusinessmodel

and our company really is. If we do this well

against such odds, imagine how we would do

without such challenges.

We remain on track to a period of slower

growth as we work hard on improving the pric-

ing power of our brands. During the fourth

quarter of 2012, we took delivery of the fifth

Solstice-class vessel, the Celebrity Reflection.

This innovative class of vessels has redefined

both the cruising experience and brand identity

for Celebrity Cruises and its guests. These

focus on product delivery

and shareholder returns.

RELENTLESS