Royal Caribbean Cruise Lines 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

During 2012, we borrowed $290.0 million under an

unsecured term loan. All amounts borrowed under the

facility will be due and payable at maturity in February

2016. Interest on the loan accrues at a floating rate

based on LIBOR plus the applicable margin. The

applicable margin varies with our debt rating and

was 2.5% as of December 31, 2012. The proceeds of

this loan were used to reduce outstanding balances

on our revolving credit facilities.

During 2012, we repurchased €255.0 million or approx-

imately $328.0 million in aggregate principal amount

of our €1.0 billion 5.625% unsecured senior notes due

2014 through a debt tender offer conducted outside

of the United States. Total consideration paid in con-

nection with the tender offer, including premium and

related fees and expenses was $344.6 million. The

repurchase of the unsecured senior notes resulted in

a loss on the early extinguishment of debt of approxi-

mately $7.5 million which was recognized in earnings

immediately and is reported within extinguishment of

unsecured senior notes in our consolidated statements

of comprehensive income (loss).

During 2012, we took delivery of Celebrity Reflection.

To finance the purchase, we borrowed $673.5 million

under our previously committed unsecured term loan

which is 95% guaranteed by Hermes. The loan amor-

tizes semi-annually over 12 years and bears interest

at LIBOR plus a margin of 0.40%, currently approxi-

mately 1.03%. In addition during 2011, we entered into

forward-starting interest rate swap agreements which

effectively convert the floating rate available to us per

the credit agreement to a fixed rate (including appli-

cable margin) of 2.85% effective April 2013 through

the remaining term of the loan. See Note 13. Fair Value

Measurements and Derivative Instruments for further

information regarding these agreements.

In November 2012, we issued $650.0 million of 5.25%

unsecured senior notes due 2022 at par. The net pro-

ceeds from the offering were used to repay amounts

outstanding under our unsecured revolving credit

facilities. The issuance of these notes was part of

our refinancing strategy for our maturities in 2013

and 2014.

During 2012, we increased the capacity of our revolv-

ing credit facility due July 2016 by $233.0 million,

bringing our total capacity under this facility to $1.1

billion as of December 31, 2012. We have the ability to

increase the capacity of this facility by an additional

$67.0 million subject to the receipt of additional or

increased lender commitments. We also have a revolv-

ing credit facility due November 2014 with capacity

of $525.0 million as of December 31, 2012, giving us

aggregate revolving borrowing capacity of $1.6 billion.

Certain of our unsecured ship financing term loans

are guaranteed by the export credit agency in the

respective country in which the ship is constructed.

In consideration for these guarantees, depending on

the financing arrangement, we pay to the applicable

export credit agency fees that range from either

(1) 0.88% to 1.48% per annum based on the outstand-

ing loan balance semi-annually over the term of the

loan (subject to adjustment in certain of our facilities

based upon our credit ratings) or (2) an upfront fee

of approximately 2.3% to 2.37% of the maximum loan

amount. We amortize the fees that are paid upfront

over the life of the loan and those that are paid semi-

annually over each respective payment period. We

classify these fees within Debt issuance costs in our

consolidated statements of cash flows and within

Other Assets in our consolidated balance sheets.

Under certain of our agreements, the contractual

interest rate, facility fee and/or export credit agency

fee vary with our debt rating.

The unsecured senior notes and senior debentures are

not redeemable prior to maturity, except that certain

series may be redeemed upon the payment of a make-

whole premium.

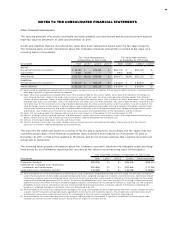

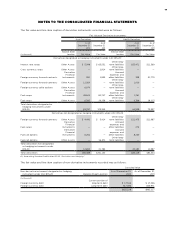

Following is a schedule of annual maturities on long-

term debt including capital leases as of December 31,

2012 for each of the next five years (in thousands):

Year

Thereafter

NOTE 8. SHAREHOLDERS’ EQUITY

In December 2012, we declared and paid a cash divi-

dend on our common stock of $0.12 per share. During

the fourth quarter of 2012, we also paid a cash divi-

dend on our common stock of $0.12 per share which

was declared during the third quarter of 2012. We

declared and paid cash dividends on our common

stock of $0.10 per share during the first and second

quarters of 2012. During the first quarter of 2012, we

also paid a cash dividend on our common stock of

$0.10 per share which was declared during the fourth

quarter of 2011.