Royal Caribbean Cruise Lines 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Other Financial Instruments

The carrying amounts of accounts receivable, accounts payable, accrued interest and accrued expenses approxi-

mate fair value at December 31, 2012 and December 31, 2011.

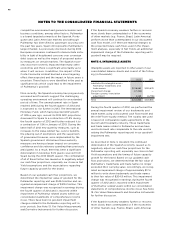

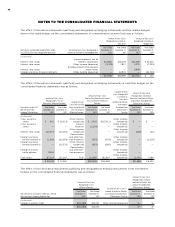

Assets and liabilities that are recorded at fair value have been categorized based upon the fair value hierarchy.

The following table presents information about the Company’s financial instruments recorded at fair value on a

recurring basis (in thousands):

Fair Value Measurements

at December 31, 2012 Using

Fair Value Measurements

at December 31, 2011 Using

Description Total Level 11Level 22Level 33Total Level 11Level 22Level 33

Assets:

Derivative financial instruments4 — — — —

Investments5 — — — —

Total Assets — —

Liabilities:

Derivative financial instruments6 — — — —

Total Liabilities — — — —

() Inputs based on quoted prices (unadjusted) in active markets for identical assets or liabilities that we have the ability to access. Valuation of these

items does not entail a significant amount of judgment.

() Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. For foreign cur-

rency forward contracts, interest rate swaps, cross currency swaps and fuel swaps, fair value is derived using valuation models that utilize the

income valuation approach. These valuation models take into account the contract terms, such as maturity as well as other inputs, such as foreign

exchange rates and curves, fuel types, fuel curves and interest rate yield curves. For fuel call options, fair value is determined by using the prevail-

ing market price for the instruments consisting of published price quotes for similar assets based on recent transactions in an active market. Fair

value for foreign currency collar options is determined by using standard option pricing models with inputs based on the options’ contract terms,

such as exercise price and maturity, and readily available public market data, such as foreign exchange curves, foreign exchange volatility levels

and discount rates. All derivative instrument fair values take into account the creditworthiness of the counterparty and the Company.

() Inputs that are unobservable. The Company did not use any Level 3 inputs as of December 31, 2012 and December 31, 2011.

() Consists of foreign currency forward contracts and collar options, interest rate swaps, cross currency swaps, fuel swaps and purchased fuel call

options. Please refer to the “Fair Value of Derivative Instruments” table for breakdown by instrument type.

() Consists of exchange-traded equity securities and mutual funds.

() Consists of interest rate swaps, fuel swaps, foreign currency forward contracts and sold fuel call options. Please refer to the “Fair Value of

Derivative Instruments” table for breakdown by instrument type.

The reported fair values are based on a variety of factors and assumptions. Accordingly, the fair values may not

represent actual values of the financial instruments that could have been realized as of December 31, 2012 or

December 31, 2011, or that will be realized in the future, and do not include expenses that could be incurred in an

actual sale or settlement.

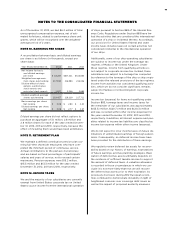

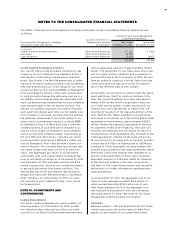

The following table presents information about the Company’s goodwill, indefinite-life intangible assets and long-

lived assets for our Pullmantur reporting unit recorded at fair value on a nonrecurring basis (in thousands):

Fair Value Measurements at December 31, 2012 Using

Description Total Level 1 Level 2 Level 3 Total Impairment

Pullmantur Goodwill1 — —

Indefinite-life intangible asset—Pullmantur

trademarks and trade names2 — —

Long-lived assets—Pullmantur aircraft3 — —

() We estimated the fair value of the Pullmantur reporting unit using a probability-weighted discounted cash flow model. The principal assumptions

used in the discounted cash flow model are projected operating results, weighted-average cost of capital, and terminal value. Significantly impact-

ing these assumptions were the anticipated future transfer of vessels from our other cruise brands to Pullmantur. The discounted cash flow model

used our 2013 projected operating results as a base. To that base we added future years’ cash flows through 2017 assuming multiple revenue and

expense scenarios that reflect the impact of different global economic environments for this period on Pullmantur’s reporting unit. We assigned a

probability to each revenue and expense scenario. We discounted the projected cash flows using rates specific to Pullmantur’s reporting unit

based on its weighted-average cost of capital, which was determined to be 10%.

() We estimated the fair value of our indefinite-life intangible asset using a discounted cash flow model and the relief-from-royalty method. We used

a royalty rate of 3% based on comparable royalty agreements in the tourism and hospitality industry. These trademarks and trade names relate

to Pullmantur and we have used a discount rate of 11%, comparable to the rate used in valuing the Pullmantur reporting unit.

() We estimated the fair value of our long-lived assets using an undiscounted cash flow model. A significant assumption in performing the undis-

counted cash flow test was the number of years during which we expect to use these aircraft.