Royal Caribbean Cruise Lines 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

PART II

assumptions and the expectations regarding future

capacity growth for the brand.

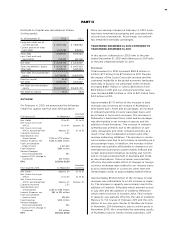

Based on our updated cash flow projections, we

determined the implied fair value of goodwill was

$145.5 million and recognized an impairment charge

of $319.2 million. Similarly, we determined that the

fair value of Pullmantur’s trademarks and trade names

no longer exceeded their carrying value. Accordingly,

we recognized an impairment charge of approximately

$17.4 million to write down trademarks and trade

names to their fair value of $204.9 million.

As part of step two of our goodwill impairment analy-

sis, we identified that the estimated fair values of

certain long-lived assets, consisting of three aircraft

owned and operated by Pullmantur Air, were less

than their carrying values. As a result, we proceeded

to our long-lived asset impairment test. Pullmantur’s

strategy to further diversify its passenger sourcing

and reduce its reliance on the Spanish market has

led us to reduce the expected years in which we will

use these aircraft when performing the undiscounted

cash flow test. The undiscounted cash flows for

Pullmantur’s aircraft were determined to be less than

their carrying value and an impairment charge of

$48.9 million was required.

The combined impairment charge of $385.4 million

related to Pullmantur’s goodwill, trademarks and

trade names and aircraft was recognized in earnings

during the quarter ended December 31, 2012 and is

reported within Impairment of Pullmantur related

assets within our consolidated statements of com-

prehensive income (loss).

The factors influencing the Spanish economy and

Pullmantur’s operating cash flows discussed above

also affect the recoverability of Pullmantur’s deferred

tax assets. During the fourth quarter of 2012, we

updated our deferred tax asset recoverability analysis

for projections included within the goodwill valuation

model discussed above. These projections, including

the impact of recently enacted laws regarding net

operating loss utilization, and the review of our tax

planning strategies show that it is no longer more-

likely-than-not that we will recover the deferred tax

assets prior to their expiration. As such, we have

determined that a 100% valuation allowance of our

deferred tax assets was required resulting in a deferred

income tax expense of $33.7 million. In addition,

Pullmantur has a deferred tax liability that was

recorded at the time of acquisition. This liability rep-

resents the tax effect of the basis difference between

the tax and book values of the trademarks and trade

names that were acquired at the time of the acquisi-

tion. Due to the impairment charge related to these

intangible assets, we reduced the deferred tax liability

by $5.2 million. The net $28.5 million impact of these

adjustments was recognized in earnings during the

fourth quarter of 2012 and is reported within Other

(expense) income in our statements of comprehensive

income (loss).

If the Spanish economy weakens further or recovers

more slowly than contemplated or if the economies

of other markets (e.g. France, Brazil, Latin America)

perform worse than contemplated in our discounted

cash flow model, or if there are material changes to

our projected future cash flows used in the impair-

ment analyses, especially in Net Yields, an additional

impairment charge of the Pullmantur reporting unit’s

goodwill, trademarks, trade names and long-lived

assets may be required.

Royal Caribbean International

During the fourth quarter of 2012, we performed

a qualitative assessment of the Royal Caribbean

International reporting unit. Based on our qualitative

assessment, we concluded that it was more-likely-

than-not that the estimated fair value of the Royal

Caribbean International reporting unit exceeded its

carrying value as of December 31, 2012 and thus, did

not proceed to the two-step goodwill impairment

test. No indicators of impairment exist primarily

because the reporting unit’s fair value has consis-

tently exceeded its carrying value by a significant

margin, its financial performance has been solid in

the face of mixed economic environments and fore-

casts of operating results generated by the reporting

unit appear sufficient to support its carrying value.

Derivative Instruments

We enter into various forward, swap and option con-

tracts to manage our interest rate exposure and to

limit our exposure to fluctuations in foreign currency

exchange rates and fuel prices. These instruments

are recorded on the balance sheet at their fair value

and the vast majority are designated as hedges. We

also have non-derivative financial instruments desig-

nated as hedges of our net investment in our foreign

operations and investments. The fuel options we have

entered into represent economic hedges which are

not designated as hedging instruments for accounting

purposes and thus, changes in their fair value are

immediately recognized in earnings. Although certain

of our derivative financial instruments do not qualify

or are not accounted for under hedge accounting,

our derivative instruments are not held for trading

or speculative purposes. We account for derivative

financial instruments in accordance with authoritative

guidance. Refer to Note 2. Summary of Significant

Accounting Policies and Note 13. Fair Value Measure-

ments and Derivative Instruments to our consolidated

financial statements for more information on related

authoritative guidance, the Company’s hedging pro-

grams and derivative financial instruments.