Royal Caribbean Cruise Lines 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

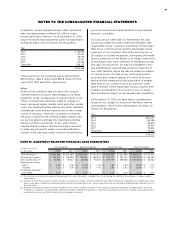

86

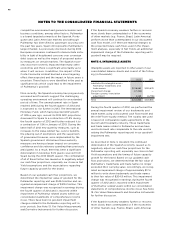

Goodwill and indefinite-life intangible assets related

to Pullmantur with a carrying amount of $459.1 million

and $218.9 million, respectively, were written down

to its implied fair value of $145.5 million and its fair

value of $204.9 million, respectively. The impairment

charges, totaling approximately $336.6 million, were

recognized during the fourth quarter of 2012 and are

reported within Impairment of Pullmantur related

assets in our consolidated statements of comprehen-

sive income (loss). Pullmantur’s goodwill and indefi-

nite-life intangible assets are reported within goodwill

and other assets, respectively, in our consolidated

balance sheets.

Long-lived assets with a carrying amount of $116.3

million, were written down to their fair value of $62.3

million, resulting in a loss of $48.9 million which was

recognized during the fourth quarter of 2012 and is

reported within Impairment of Pullmantur related

assets in our consolidated statements of comprehen-

sive income (loss). Long-lived assets are reported

within property and equipment, net in our consoli-

dated balance sheets.

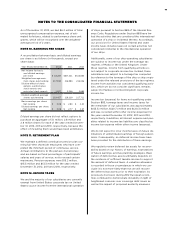

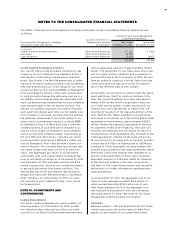

DERIVATIVE INSTRUMENTS

We are exposed to market risk attributable to changes

in interest rates, foreign currency exchange rates and

fuel prices. We manage these risks through a combi-

nation of our normal operating and financing activities

and through the use of derivative financial instruments

pursuant to our hedging practices and policies. The

financial impact of these hedging instruments is pri-

marily offset by corresponding changes in the under-

lying exposures being hedged. We achieve this by

closely matching the amount, term and conditions of

the derivative instrument with the underlying risk being

hedged. Although certain of our derivative financial

instruments do not qualify or are not accounted for

under hedge accounting, we do not hold or issue

derivative financial instruments for trading or other

speculative purposes. We monitor our derivative posi-

tions using techniques including market valuations

and sensitivity analyses.

We enter into various forward, swap and option con-

tracts to manage our interest rate exposure and to

limit our exposure to fluctuations in foreign currency

exchange rates and fuel prices. These instruments are

recorded on the balance sheet at their fair value and

the vast majority are designated as hedges. We also

have non-derivative financial instruments designated

as hedges of our net investment in our foreign opera-

tions and investments.

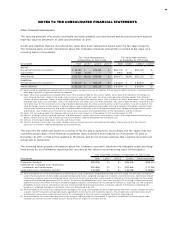

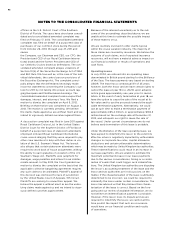

At inception of the hedge relationship, a derivative

instrument that hedges the exposure to changes in

the fair value of a firm commitment or a recognized

asset or liability is designated as a fair value hedge.

A derivative instrument that hedges a forecasted

transaction or the variability of cash flows related to

a recognized asset or liability is designated as a cash

flow hedge.

Changes in the fair value of derivatives that are desig-

nated as fair value hedges are offset against changes

in the fair value of the underlying hedged assets,

liabilities or firm commitments. Gains and losses on

derivatives that are designated as cash flow hedges

are recorded as a component of accumulated other

comprehensive (loss) income until the underlying

hedged transactions are recognized in earnings. The

foreign currency transaction gain or loss of our non-

derivative financial instruments designated as hedges

of our net investment in foreign operations and

investments are recognized as a component of accu-

mulated other comprehensive (loss) income along

with the associated foreign currency translation

adjustment of the foreign operation.

On an ongoing basis, we assess whether derivatives

used in hedging transactions are “highly effective”

in offsetting changes in the fair value or cash flow of

hedged items. We use the long-haul method to assess

hedge effectiveness using regression analysis for each

hedge relationship under our interest rate, foreign

currency and fuel hedging programs. We apply the

same methodology on a consistent basis for assessing

hedge effectiveness to all hedges within each hedging

program (i.e. interest rate, foreign currency and fuel).

We perform regression analyses over an observation

period commensurate with the contractual life of the

derivative instrument, up to three years for interest

rate and foreign currency relationships and four years

for fuel relationships. High effectiveness is achieved

when a statistically valid relationship reflects a high

degree of offset and correlation between the changes

in the fair values of the derivative instrument and the

hedged item. The determination of ineffectiveness

is based on the amount of dollar offset between the

change in fair value of the derivative instrument and

the change in fair value of the hedged item at the

end of the reporting period. If it is determined that a

derivative is not highly effective as a hedge or hedge

accounting is discontinued, any change in fair value

of the derivative since the last date at which it was

determined to be effective is recognized in earnings.

In addition, the ineffective portion of our highly effec-

tive hedges is recognized in earnings immediately and

reported in other income (expense) in our consoli-

dated statements of comprehensive income (loss).

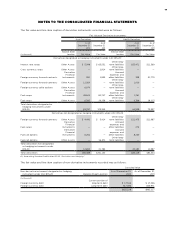

Cash flows from derivative instruments that are desig-

nated as fair value or cash flow hedges are classified in

the same category as the cash flows from the under-

lying hedged items. In the event that hedge account-

ing is discontinued, cash flows subsequent to the

date of discontinuance are classified within investing

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS