Royal Caribbean Cruise Lines 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

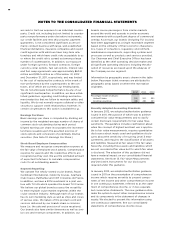

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

competitive environment and general economic and

business conditions, among other factors. Pullmantur

is a brand targeted primarily at the Spanish, Portu-

guese and Latin American markets and although

Pullmantur has diversified its passenger sourcing over

the past few years, Spain still represents Pullmantur’s

largest market. As previously disclosed, during 2012

European economies continued to demonstrate insta-

bility in light of heightened concerns over sovereign

debt issues as well as the impact of proposed auster-

ity measures on certain markets. The Spanish econ-

omy was more severely impacted than many other

economies and there is significant uncertainty as to

when it will recover. In addition, the impact of the

Costa Concordia incident has had a more lingering

effect than expected and the impact in future years is

uncertain. These factors were identified in the past as

significant risks which could lead to the impairment

of Pullmantur’s goodwill.

More recently, the Spanish economy has progressively

worsened and forecasts suggest the challenging

operating environment will continue for an extended

period of time. The unemployment rate in Spain

reached 26% during the fourth quarter of 2012 and

is expected to rise further in 2013. The International

Monetary Fund, which had projected GDP growth

of 1.8% a year ago, revised its 2013 GDP projections

downward for Spain to a contraction of 1.3% during

the fourth quarter of 2012 and further reduced it to

a contraction of 1.5% in January of 2013. During the

latter half of 2012 new austerity measures, such as

increases to the Value Added Tax, cuts to benefits,

the phasing out of exemptions and the suspension

of government bonuses, were implemented by the

Spanish government. We believe these austerity

measures are having a larger impact on consumer

confidence and discretionary spending than previously

anticipated. As a result, there has been a significant

deterioration in bookings from guests sourced from

Spain during the 2013 WAVE season. The combination

of all of these factors has caused us to negatively adjust

our cash flow projections, especially our closer-in Net

Yield assumptions and the expectations regarding

future capacity growth for the brand.

Based on our updated cash flow projections, we

determined the implied fair value of goodwill for the

Pullmantur reporting unit was $145.5 million and rec-

ognized an impairment charge of $319.2 million. This

impairment charge was recognized in earnings during

the fourth quarter of 2012 and is reported within

Impairment of Pullmantur related assets within our

consolidated statements of comprehensive income

(loss). There have been no goodwill impairment

charges related to the Pullmantur reporting unit in

prior periods. See Note 13. Fair Value Measurements

and Derivative Instruments for further discussion.

If the Spanish economy weakens further or recovers

more slowly than contemplated or if the economies

of other markets (e.g. France, Brazil, Latin America)

perform worse than contemplated in our discounted

cash flow model, or if there are material changes to

the projected future cash flows used in the impair-

ment analyses, especially in Net Yields, an additional

impairment charge of the Pullmantur reporting unit’s

goodwill may be required.

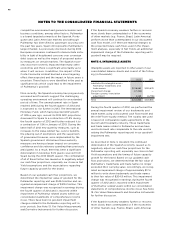

NOTE 4. INTANGIBLE ASSETS

Intangible assets are reported in other assets in our

consolidated balance sheets and consist of the follow-

ing (in thousands):

Indefinite-life intangible asset—

Pullmantur trademarks and

trade names

Impairment charge () —

Foreign currency translation

adjustment ()

Total

During the fourth quarter of 2012, we performed the

annual impairment review of our trademarks and

trade names using a discounted cash flow model and

the relief-from-royalty method. The royalty rate used

is based on comparable royalty agreements in the

tourism and hospitality industry. These trademarks

and trade names relate to Pullmantur and we have

used a discount rate comparable to the rate used in

valuing the Pullmantur reporting unit in our goodwill

impairment test.

As described in Note 3. Goodwill, the continued

deterioration of the Spanish economy caused us to

negatively adjust our cash flow projections for the

Pullmantur reporting unit, especially our closer-in Net

Yield assumptions and the timing of future capacity

growth for the brand. Based on our updated cash

flow projections, we determined that the fair value of

Pullmantur’s trademarks and trade names no longer

exceeded their carrying value. Accordingly, we recog-

nized an impairment charge of approximately $17.4

million to write down trademarks and trade names

to their fair value of $204.9 million. This impairment

charge was recognized in earnings during the fourth

quarter of 2012 and is reported within Impairment

of Pullmantur related assets within our consolidated

statements of comprehensive income (loss). See Note

13. Fair Value Measurements and Derivative Instruments

for further discussion.

If the Spanish economy weakens further or recovers

more slowly than contemplated or if the economies

of other markets (e.g. France, Brazil, Latin America)